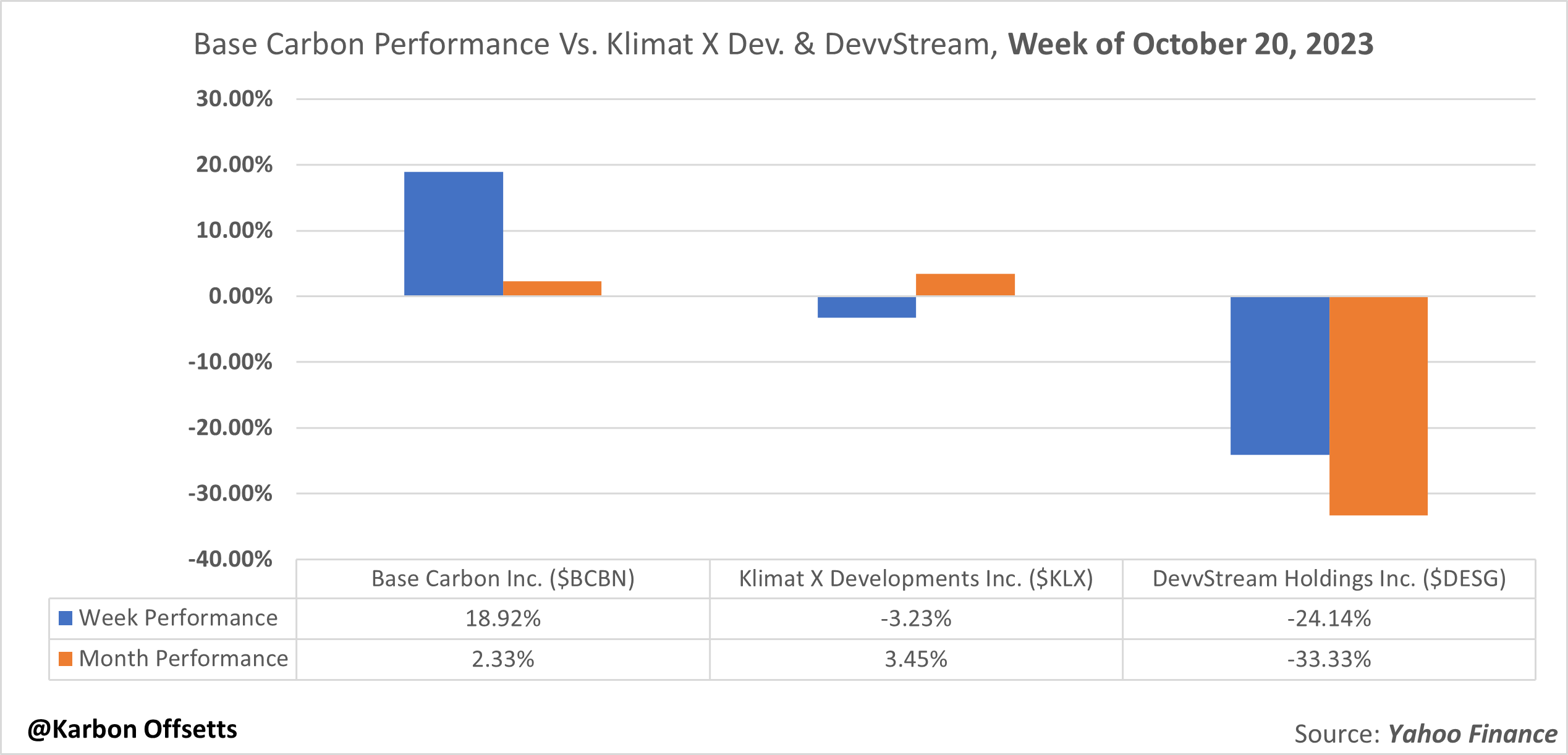

While many have ten (10) screens open, and others are waiting for markets to roll over for fundamentals to play out, I personally enjoy being the only one in a trade. This makes trading carbon credit stocks so exciting, especially throughout this earnings period when many investors are sitting in nearly risk-free Treasury bills, or T-bills, as interest rates have risen. However, this week, while many had their eyes on the shares of Tesla, which opened at $257.18 and closed at $211.99 (a massive disappointment for many with a draw-down of almost -15.22%), we had shares in Base Carbon Inc. (CBOE:BCBN) which opened at $0.37 and ended the week at $0.44, a massive 18.92% gain.

To really profit from risk management, it’s imperative to gauge daily levels and weekly levels and put stop losses into gear. Rather than a time of low-interest rates that result in being rewarded for risk-taking, which undoubtedly in a regime of high-interest rates, you’ll have to play defensively that amounts to your offence and not the opposite. Regardless of Base Carbon Inc.’s performance this week, there are other champions when you gaze upon long-term prospects.

Three Carbon Credit stocks to add to your watch-list. As demand destruction hits, and the federal reserves and central banks are forced to cut overnight rates, these stocks won’t be waiting for anyone; they will rocket, and they include:

- DevvStream Holdings Inc. (CBOE:DESG)

- Corporate Presentation: DevvStream

- Key Highlights: Focus on technology-based projects, blockchain transparency, strong ESG principles, and efficient revenue model.

- Klimat X Development Inc. (TSXV:KLX)

- Corporate Presentation: Klimat X Development Inc.

- Key Highlights: Proven track record, strategic agreements, and significant potential in carbon credit projects.

- Zefiro Methane Corp.

- Corporate Presentation: Zefiro Methane Corp.

- Key Highlights: Pioneering solutions to unfunded well-plugging liabilities, with a focus on environmental monitoring, asset retirement, and carbon offsets.

Technology-based solutions to generate Carbon Credits

DevvStream Holdings Inc. is already a public company with plans in motion to uplist to NASDAQ, improving access to capital and investor transparency. Markets have not yet recognized its prospects. Investing in DevvStream is an exciting opportunity in the carbon credit space. They focus on technology-based projects, use blockchain for transparency, and emphasize ESG principles. Their revenue model is efficient, generating compliance credits for recurring income. With over 90% of their 2025 credits being tech-based and high-margin, they offer a credible and transparent option for investors. It’s a unique chance to invest in sustainable growth and financial returns.

- Share Price: $0.66

- Market cap: $21.83 million (as of October 22, 2023)

- September 2023 Corporate Presentation here: DevvStream

Conservation and Restoration Carbon Credit

Klimat X Development Inc. is an appealing investment option with a proven track record, including an agreement with a Fortune 100 company for up to 1.9MMt carbon credits from 5000 ha in Sierra Leone. As demand for carbon credits is set to surge to $30 billion by 2030, Klimat X’s Credit Producer Model and 43 million tonnes in potential projects are promising. They offer recurring revenues starting as early as 2024 and a robust growth trajectory, making them a compelling choice for investors.

- Share Price: $0.15

- Market cap: $14.01 million (as of October 22, 2023)

- August 2023 Corporate Presentation here: Klimat X Development Inc.

Carbon Offsets through High-quality plugging solutions of Abandoned Oil and Gas Wells

Soon to be listed on Canadian capital markets, Zefiro Methane Corp. is not just another company; it’s a pioneer answering the critical challenge of unfunded well-plugging liabilities while propelling the upstream energy sector towards a Net Zero future. I am extremely excited for this team and really love their management team. With three distinct revenue streams, including Environmental Monitoring, Asset Retirement, and Carbon Offsets, Zefiro is set to make a resounding impact. Zefiro’s mission is clear: to reduce greenhouse gas emissions by preventing leaks from abandoned oil and gas wells through high-quality plugging solutions. This isn’t just an investment opportunity; it’s a visionary response to a US$400-600 billion methane emissions problem. The experienced Zefiro team has a proven track record in creating high-quality carbon offset projects and revolutionizing methodologies in the oil and gas sector. As demand races to overtake supply, the recent US$4.7 billion investment from the US IIJA bill further emphasizes the urgency and potential impact of Zefiro Methane Corp in transforming the energy landscape.

- Share Price: Coming Soon

- Market cap: Coming Soon

- September 2023 Corporate Presentation here: Zefiro Methane Corp.

One more thing to leave you with before you go investing in any carbon credit stocks:

- Do your research: A great place to start is SedarPLUS or Edgar. Know whether a company is getting close to being washed out (bankrupted). Look for signs like increasing debt, dwindling cash flow, management changes, legal issues, and other financial health risks.

- Consult your financial advisor: Allow them to sit down with you to gauge your investing appetite and risk tolerance, and to prescribe the right investment strategy that suits your financial situation. Make sure it’s a reputable one.

HEY! For the hedge funds out there, if you get washed out of your positions, look forward to borrowing at the bottom again with you.