Aker Carbon Capture (OTCMKTS: AKCCF), a pure-play carbon capture company deploying ready-to-use capture plants with over two decades of experience, has successfully deployed close to two handful carbon capture plants and has validated its technology across various industries and regions.

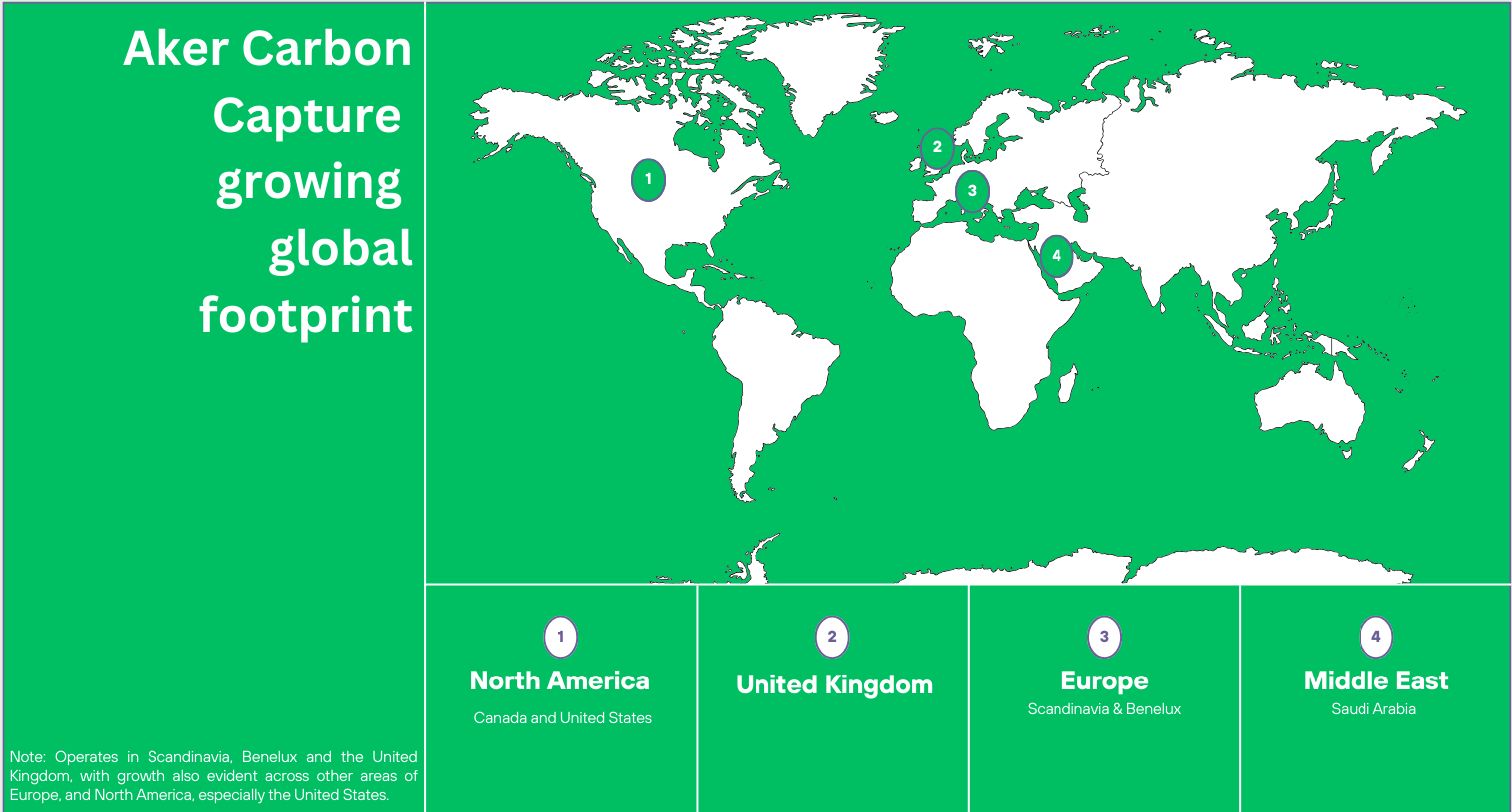

With a global footprint in the United Kingdom, Europe, the Middle East, and North America, and a notable partnership with Saudi Arabia’s Aramco to deploy carbon capture, utilization, and storage (CCUS) and industrial modularization in the Kingdom, Aker Carbon Capture is embarking on another phase in its growth trajectory.

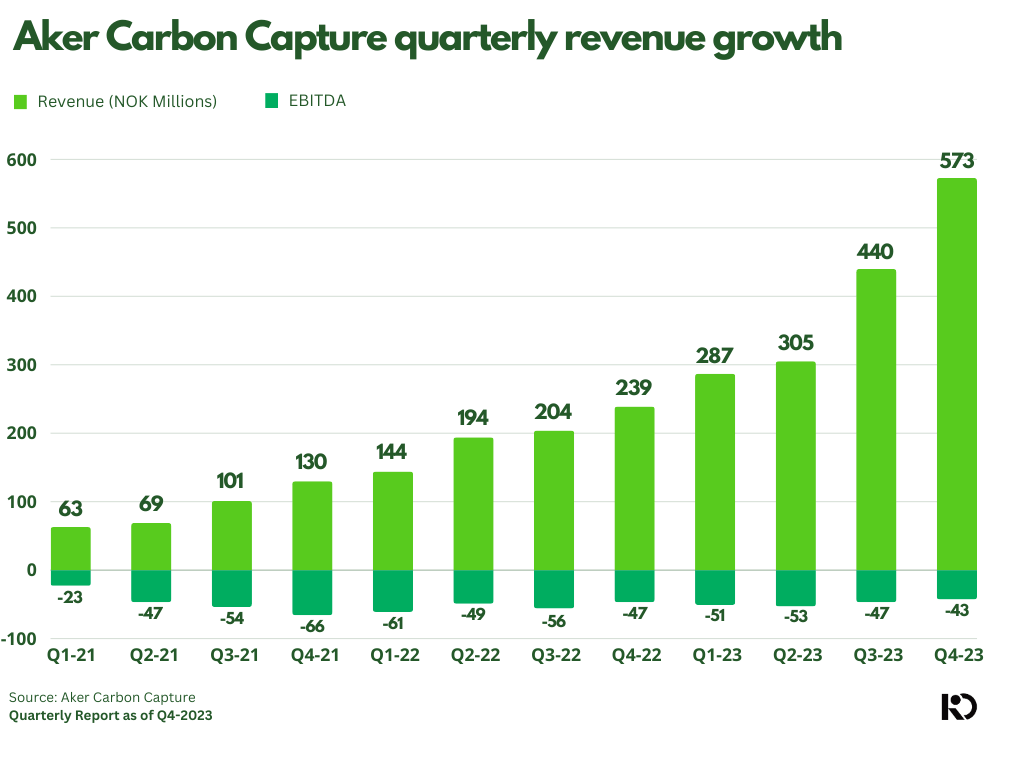

Revenue Growth is in its DNA. Private and public investment markets may not have yet noticed the great work Aker Carbon Capture has been doing, with quarter-over-quarter revenue growth. With a bulk of the revenue acceleration and surprise coming from its Norway and Netherlands projects, and profits from its Ørsted Kalundborg CCS project pending recognition. Aker Carbon Capture team isn’t waiting on anyone to recognize its mission to accelerate planet positive.

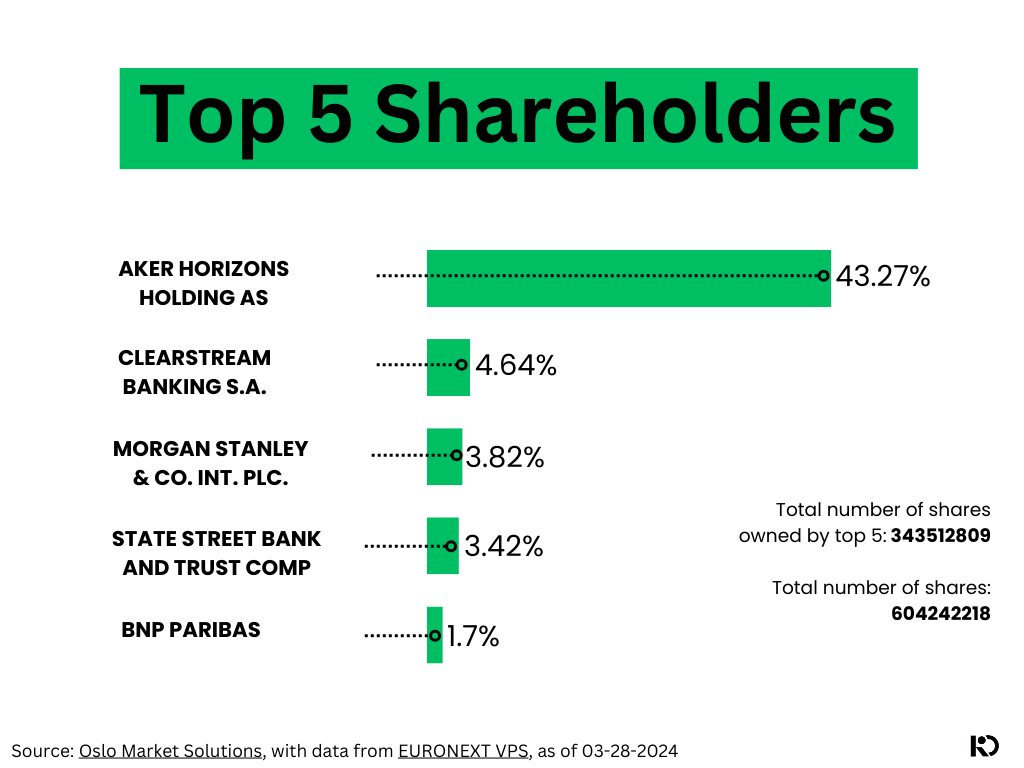

Who is Holding Aker Carbon Capture Shares. The top five (5) shareholders include AKER HORIZONS HOLDING AS, Clearstream Banking S.A., Morgan Stanley & CO. Int. PLC., State Street Bank and Trust Company, and BNP Paribas, which collectively own 56.85% of shares as of 03-28-2024.

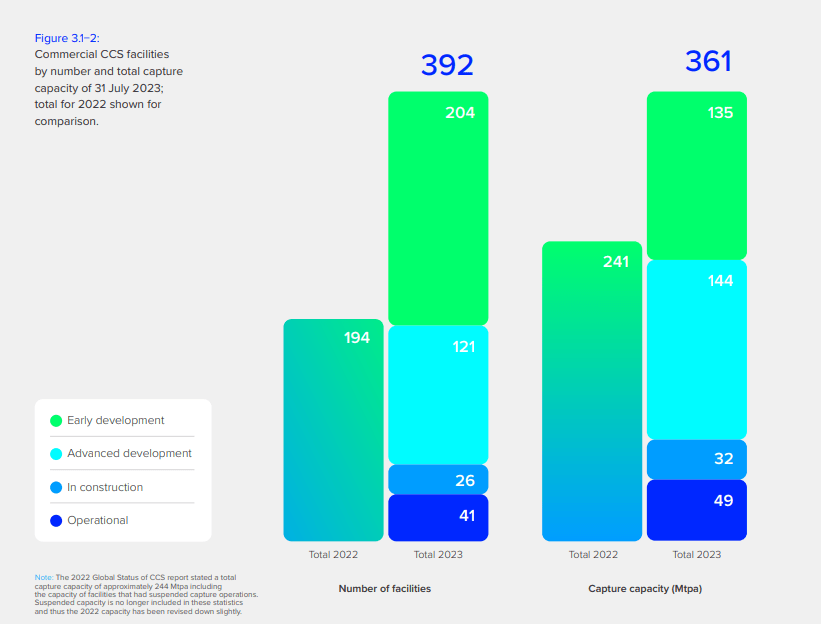

The carbon capture market is vibrant and active as policymakers in developed countries move towards meeting their net-zero targets, and developing countries seek foreign direct investment in the energy transformation race. As of 2023, there are 325 carbon capture facilities in advanced and early development reported by the Global CCS Institute, and 2024 shows further expansion with Aker Carbon Capture’s growth.

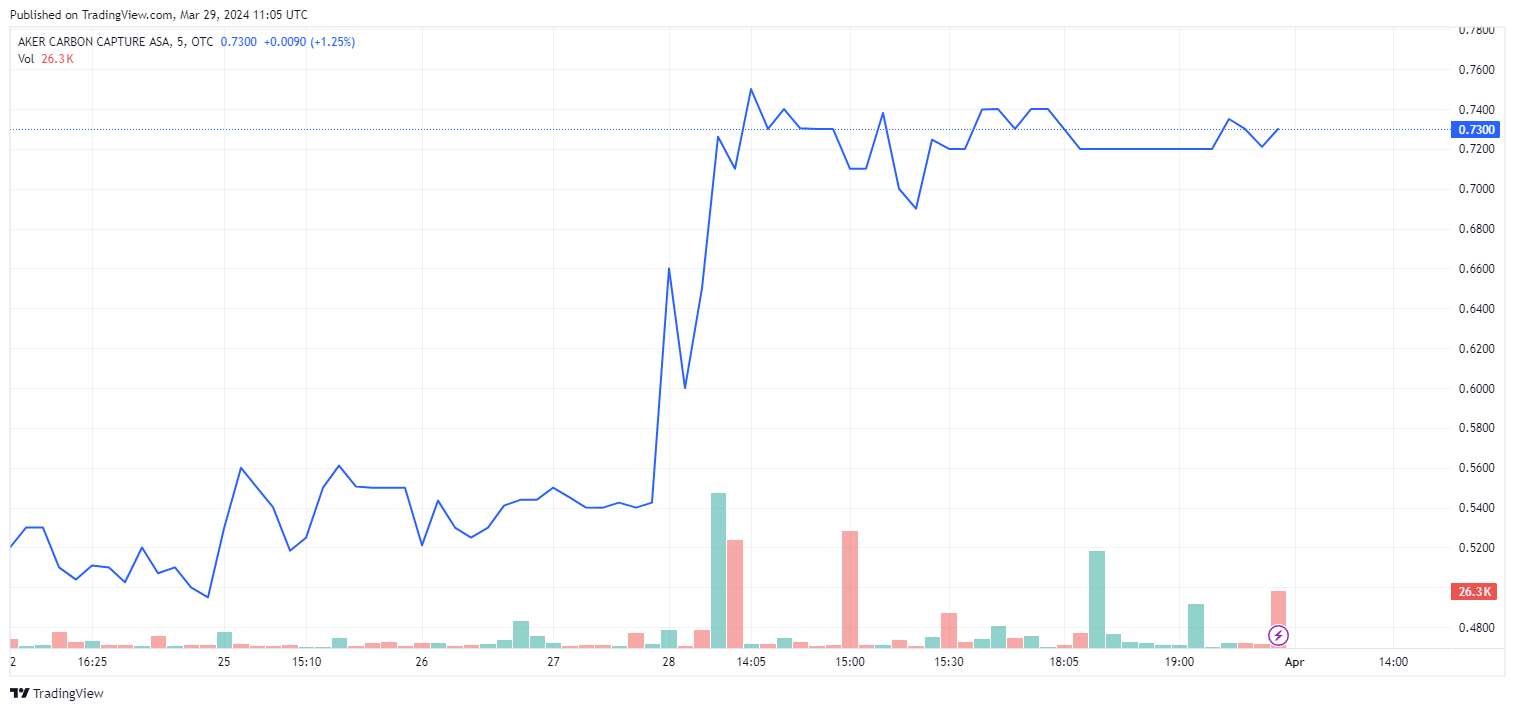

A Recent Partnership. Reported in a press release on March 27, 2024, Schlumberger Limited and Aker Carbon Capture are combining their carbon capture portfolios in a deal expected to credit Aker Carbon Capture Holding AS (ACCH) with NOK 4.12 billion. This arrangement allows Schlumberger Limited to own 80% of Aker Carbon Capture, leaving Aker Carbon Capture to own the remaining 20%. The transaction is expected to close by the end of Q2 2024, with a potential earnout option by Schlumberger Limited of up to a maximum of NOK 1.36 billion within the next three years, contingent upon the business’s operational performance.

On LinkedIn, Chief Executive Officer Egil Andre Fagerland commented on the partnership announcement: “How to meet the demand for CCUS and deliver net zero? Working together!”

“For CCUS to have the expected impact on supporting global net-zero ambitions, it will need to scale up 100-200 times in less than three decades,” said Olivier Le Peuch, Chief Executive Officer of SLB. “Crucial to this scale-up is the ability to lower capture costs, which often represent as much as 50-70% of the total spend of a CCUS project. We are excited to create this business with ACC to accelerate the deployment of carbon capture technologies that will shift the economics of carbon capture across high-emitting industrial sectors.”

The joint venture with Schlumberger Limited has seen Aker Carbon Capture stock, which bottomed on March 22, 2024, at 0.4950, experience a significant increase in its share price to 0.73 on Over-the-counter (OTC) markets.

Whether you’re in the sustainability community, a speculator or global investment manager; Aker Carbon Capture alongside it’s CEO and team should be on your radar as the world moves to cap CO2 emissions.

Note: None of the statements provided should be construed as a recommendation to buy or purchase Aker Carbon Capture equities. Please seek investment advice from your financial advisor.