- We risk allocating capital to the wrong sectors, all in the spirit to shore up success in the energy transition or carbon removal environment

- We must be wary of potentially allocating taxpayers’ money unto fancily written proposal to shore up too many projects not being viable in the wrong places

- Numerous conversations being had lean vastly on wishful thinking. Which is rather fine for conversation’s sake, however, in the realm of deriving solutions, cost and price should be drawn centre-stage rather than omitted

Backstory!

While I was in Nice, France, attending the Monaco Grand Prix in 2022, an interesting conversation unfolded while boarding the plane. It’s worth noting that France had recently lifted its mask requirements. Amid this more relaxed setting, three friends engaged in a passionate discussion in French. The topic revolved around the limited range of an electric vehicle (EV) owned by one of them.

During the conversation, one friend suggested an alternative vehicle to the electric vehicle – why not consider a hydrogen car?

Here’s the thing. This story serves as a reminder of a crucial aspect in our energy choices: the cost. While the friend proposing the hydrogen car might not have been worried about price or cost, and the conversation was not drawn-out to serve as a framework or solution to serve its constituents, it highlights an important point. When it comes to energy decisions, whether for policymakers, climate activists, or anyone else, thinking about the cost or price is vital.

Why? Because here’s the thing. For the young fellow who suggested to his friend – a hydrogen car, cost might not have been a big deal. But for policymakers and climate activists, it should be a top consideration; a major factor to highlight a lot more in our conversations. Especially, throughout COP28, numerous conversations being had lean vastly on wishful thinking. Which is rather fine for conversation’s sake, however, in the realm of deriving solutions, cost and price should be drawn centre-stage rather than omitted. While echoing comparisons to other energy transition or carbon removal solutions.

Hear me out. It’s not just about fighting climate change; it’s about being financially responsible. In the hopes of nudging future generations to be aware of hefty debts, alongside the environmental challenges. So, in our quest for sustainable energy or energy transition or carbon removal space, let’s not forget the importance of balancing environmental concerns with economic prudence or making it noteworthy in our conversations.

For example, when delving into the domain of hydrogen energy, there are specifically eleven types that exhibit distinct characteristics. Sincerely, I was aiming to omit “grey hydrogen” from the table below. However, in the spirit of technology neutrality, the table provides rough estimates of the electricity consumption in kilowatt-hours (kWh) necessary to produce 1 kilogram of each type of hydrogen, along with their distinct advantages and disadvantages associated with each classification.

Type of fuel |

Advantages |

Disadvantages |

Electricity consumption |

Green Hydrogen |

· Produced from renewable energy like solar, wind, and hydro.

· It can be produced using nuclear power. · Eliminates harmful pollutants like sulphur dioxide and nitrogen oxides. |

· Higher production cost compared to grey hydrogen from fossil fuels.

· Challenges in scaling up solid oxide electrolyzer systems |

[1] 50-55 KWh/kg

|

Blue hydrogen |

· Uses natural gas, similar to grey hydrogen.

· Carbon capture and storage reduce emissions. · Low-CO2 production emissions range from 23 to 150 g/kWh · Available at short notice compared to green hydrogen · It can be used for storing green electricity, electricity, and heat generation, and as a fuel in transportation |

· It still relies on fossil fuels for production.

· Not fully CO2-neutral · Transitionary technology until green hydrogen is more widespread · The long-term goal is to replace it with green hydrogen · Potential dependence on fossil fuel infrastructure |

[1] 40-55 kWh/kg

|

Turquoise Hydrogen |

· Utilizes both electricity and methane, reducing electricity needs compared to electrolysis

· Potential negative carbon footprint when methane comes from biogas · Lower CO2 emissions compared to traditional hydrogen production methods · Adds value to the carbon produced, with applications in tire manufacturing |

· Requires electricity and methane, which may still involve fossil fuels

· Presence of CO2 emissions depending on the source of methane · The economic model initially focused on black carbon production · Commercialization and widespread adoption have not yet been achieved · Optimization for hydrogen production is a future consideration |

[2] 10-30 kwh/kg

|

Pink Hydrogen |

· Utilizes nuclear energy, providing a low-carbon alternative

· Potential to produce low-carbon hydrogen, reducing CO2 emissions |

· It relies on nuclear power, which comes with its challenges

· Concerns related to nuclear energy safety and waste |

[3] 50-55Kwh/kg

|

White Hydrogen |

· No direct use of fossil fuels or electricity during production

· Can contribute to decarbonization in various industries |

· The fracking process may have environmental and sustainability concerns

· Current production options are expensive or not environmentally safe |

[4] 55-60 Kwh/kg

|

Grey hydrogen |

· Well-established technology

· Cost-competitive initially compared to other types of hydrogen

|

· High carbon footprint

· Dependence on fossil fuels like natural gas · Not sustainable in the long term |

[1] 40-50Kwh/kg

|

Black Hydrogen |

· Zero carbon emissions during production

· Utilizes advanced, clean energy technologies · Potential for carbon capture and utilization |

· Emerging technology with limited scalability

· High upfront costs · Infrastructure development challenges |

[5] 50-55Kwh/kg

|

Brown Hydrogen |

· Utilizes existing coal infrastructure

· Cost-competitive compared to green methods · Economic viability in certain regions |

· High carbon emissions, non-renewable source

· Environmental impact of coal extraction · Limited long-term sustainability |

[6] 40Kwh/kg

|

Purple Hydrogen |

· Low carbon emissions through sustainable production

· Harnesses renewable energy for hydrogen · Potential for widespread scalability |

· Technologically complex, research-intensive

· Initial implementation costs are high · Infrastructure development challenges |

[5] 50-55Kwh/kg

|

Dark Green Hydrogen |

· Zero carbon emissions, fully renewable

· Utilizes electrolysis powered by renewable energy · Sustainable and environmentally friendly |

· High initial costs for renewable infrastructure

· Availability of low-cost renewable energy · Limited scalability without sufficient renewables |

[7] 50-55 Kwh/kg

|

Yellow Hydrogen |

· Production from nuclear power reduces carbon footprint

· High energy density and efficiency · Relatively lower greenhouse gas emissions compared to grey hydrogen |

· Nuclear safety concerns and public perception

· High initial costs for nuclear infrastructure · Limited availability of suitable nuclear sites |

[8] 50Kwh/kg

|

Perfect! You have the energy consumption of each hydrogen fuel. How much would it cost to price electricity in your region against the energy consumption in kilowatt-hours (kWh) to produce 1 kilogram of each type of hydrogen?

Use the below equation:

C=E x P

C= Total Cost

E= Energy consumption in kilowatt-hours (kWh)

P= Electricity per kilowatt-hour in your currency

Thereinafter, please inform me which hydrogen fuel would best suit your country, state, city, or town. Is it economical or affordable, or is it rather expensive?

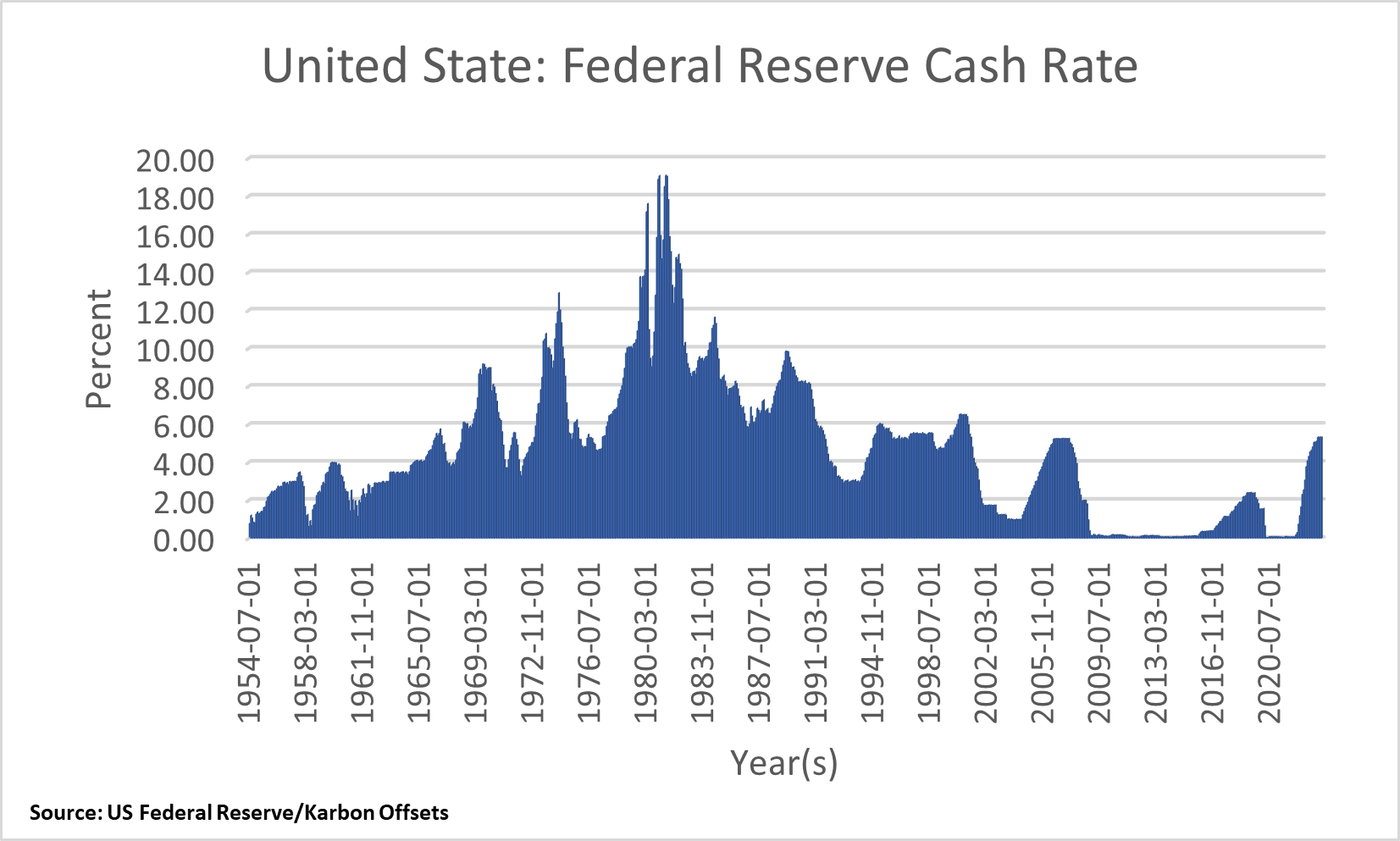

But that’s not all. Warren Buffett’s famous quote reads: “Only when the tide goes out do you discover who’s been swimming naked.” Currently, the energy transition and carbon removal financing space are facing major headwinds, with central banks in Group of Seven nations all raising cash rates to cool down consumer price inflation. Notably, the Federal Reserve in the United States saw its cash rate rise from 0.20% in March of 2022 to a massive 5.33% currently.

Looking at conversations throughout COP28, many, through omission or commission, fail to acknowledge the cost of borrowing.

As of late, we’ve witnessed an array of bankruptcies in the renewable spaces in the United States and European Union companies. Though faced with an array of different challenges, the European Union situation bears your attention. In addition, spotting the stock of the renewable utility company “Orsted A/S” see significant drawbacks in the stock market, with a pullback of 48.09% year-to-date.

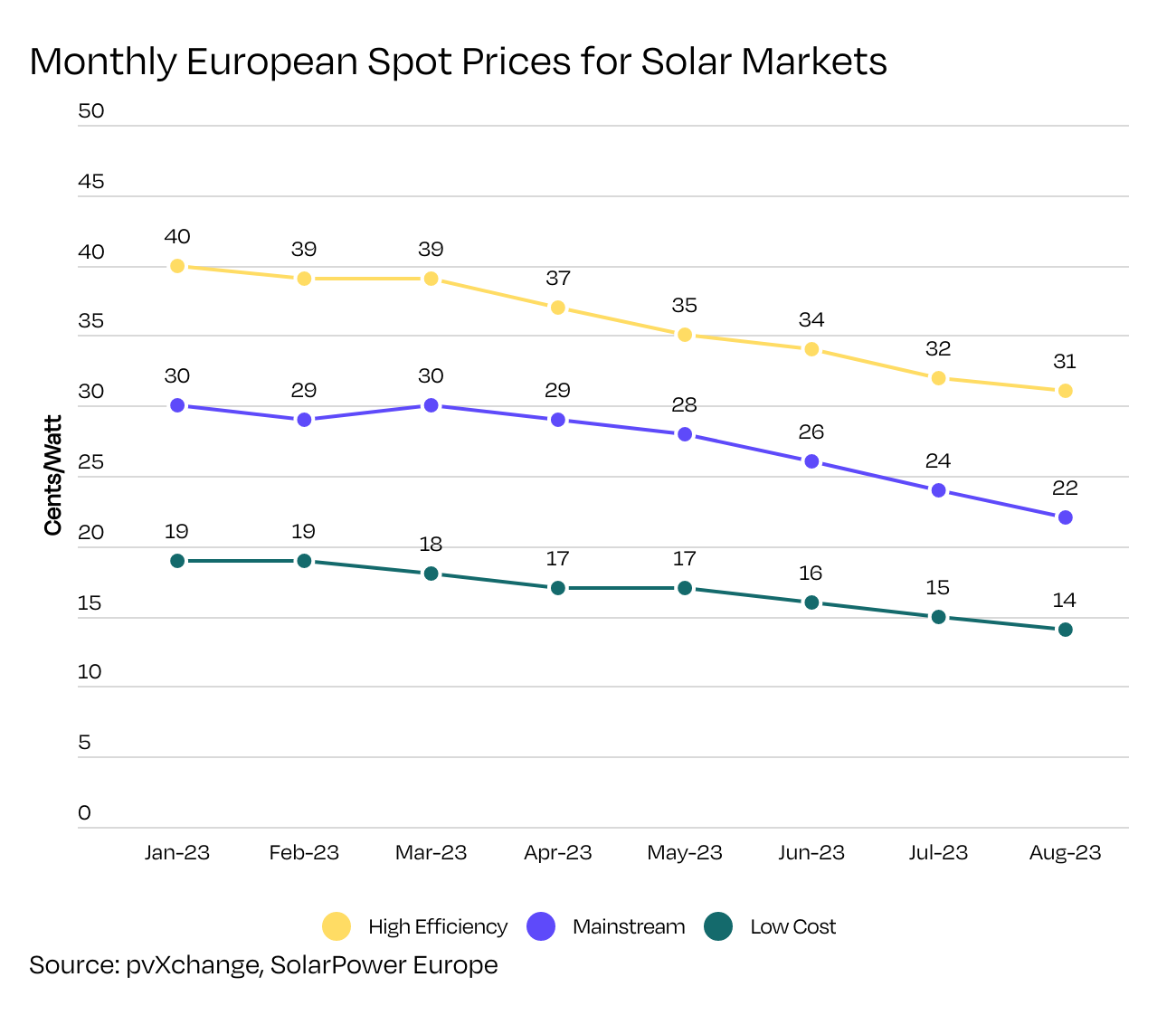

A recent letter sent to the EU Commission by SolarPower Europe echoed how the price of solar PV modules had dropped 25% to below 0.15EUR/W. However, it emphasized how the drop in price puts European PV companies at risk of not being able to compete, placing them in a precarious situation to file for bankruptcy.

Rather strange, isn’t it? The price of a good is low (down 25%), and interest rates are high. This is a perfect example of the interplay between cost and price, and the stress placed on financial statements.

We can’t continue to attend summits, forums, and conferences without discussing the setbacks faced by the carbon removal or energy transition space via the hindsight or foresight of cost and price. As we risk allocating capital to the wrong sectors, all in the spirit to shore up success in the energy transition or carbon removal environment. In turn, creating a misallocation of capital which will leave future generations holding onto hefty debts.

A word of caution for policymakers and activists at COP28 or future energy transition or carbon removal events: shed light on the cost and price of your solution and explain why it is advantageous compared to other solutions in your region. Conversely, analyze the cost and price of a disadvantageous solution.

The game plan remains focused on working towards energy transition or carbon removal goals. However, we must be wary of potentially allocating taxpayers’ money unto fancily written proposal to shore up too many projects not being viable in the wrong places.

____________________________________________________________________________________________

[1] Kumar, A. (2023, May 19). Comparing Green, Blue, and Grey Hydrogen: Exploring Pathways. LinkedIn. Retrieved from https://www.linkedin.com/pulse/comparing-green-blue-grey-hydrogen-exploring-pathways-kumar-anik-#:~:text=Blue%20hydrogen%20can%20significantly%20reduce,1%20kilogram%20of%20blue%20hydrogen

[2] Science Direct. (2022). Why Turquoise Hydrogen Will Be a Game Changer for The Energy Transition. Retrieved from https://www.sciencedirect.com/science/article/abs/pii/S0360319922024983

[3] 3Degrees Inc. (n.d.). Hydrogen Production: Exploring Various Methods and Climate Impact. Retrieved from https://3degreesinc.com/resources/hydrogen-production-exploring-various-methods-climate-impact/

[4] CleanTechnica. (2023, August). No, White Hydrogen Isn’t a Limitless Source of Clean Fuel. CleanTechnica. Retrieved from https://cleantechnica.com/2023/08/07/no-white-hydrogen-isnt-a-limitless-source-of-clean-fuel/

[5] MDPI. (2023).The Hydrogen Color Spectrum: Techno-Economic Analysis of the Available Technologies for Hydrogen Production. Retrieved from https://www.mdpi.com/2673-5628/3/1/2

[6] International Renewable Energy Agency. (2022, May). Global Hydrogen Trade Costs 2022. Retrieved from https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/May/IRENA_Global_Hydrogen_Trade_Costs_2022.pdf

[7] PCI Energy Solutions. (2022, July 20). Colors of Hydrogen: Economics of Green, Blue, and Gray Hydrogen. Retrieved from https://www.pcienergysolutions.com/2022/07/20/colors-of-hydrogen-economics-of-green-blue-and-gray-hydrogen/

[8] Swinburne University. (2022, May). The Colours of Hydrogen Explained. Swinburne University of Technology. Retrieved from https://www.swinburne.edu.au/news/2022/05/the-colours-of-hydrogen-explained/