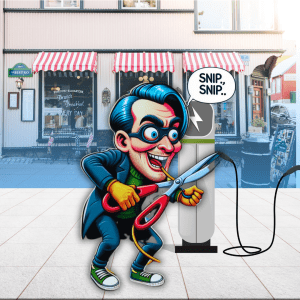

DynaCERT Inc. recently announced on May 16, 2024, a $2.5 million non-brokered private placement of up to 16.67 million units at $0.15 each. The proceeds from the private placement are intended to fund its HydraGEN Technology sales (Chart 1), provide working capital, repay debt, manage advisory fees, and support general corporate purposes.

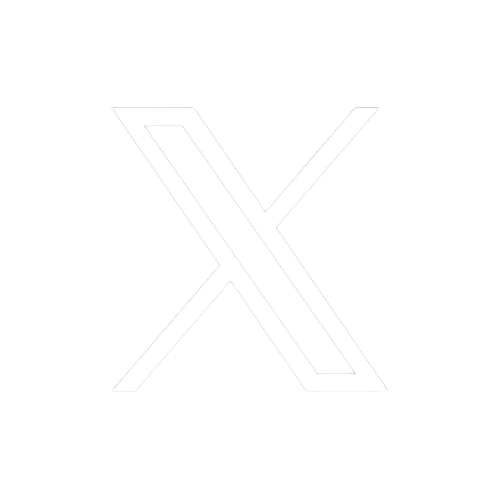

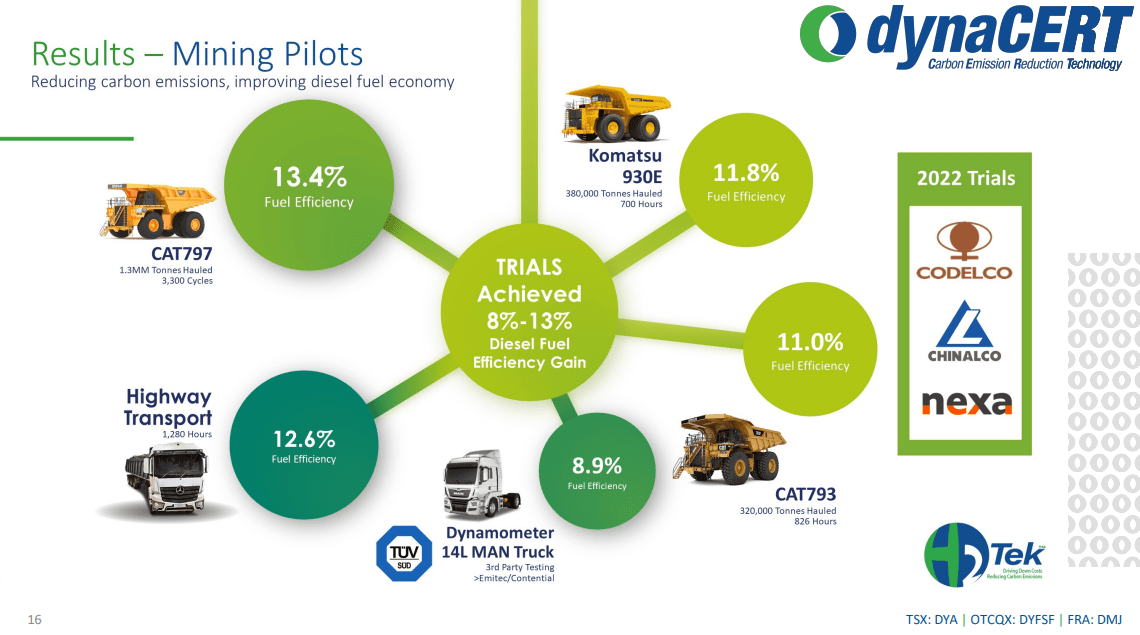

The company offers cutting-edge carbon emission reduction technology for use with internal combustion engines (ICE). As a contributor to the expanding global hydrogen economy, their patented technology utilizes a specialized electrolysis system to produce hydrogen and oxygen on demand. These gases are then introduced into the engine’s air intake, improving combustion efficiency. This process results in reduced carbon emissions, increased fuel efficiency (Chart 2), and cost savings on maintenance.

After reviewing its recent ‘Management’s Discussion and Analysis’ report, among many other topical items, the following points caught my attention, prompting me to place an asymmetric bet on dynaCERT due to its compelling and diverse range of strategic options.

Expanding Horizons: Market Penetration of Patents

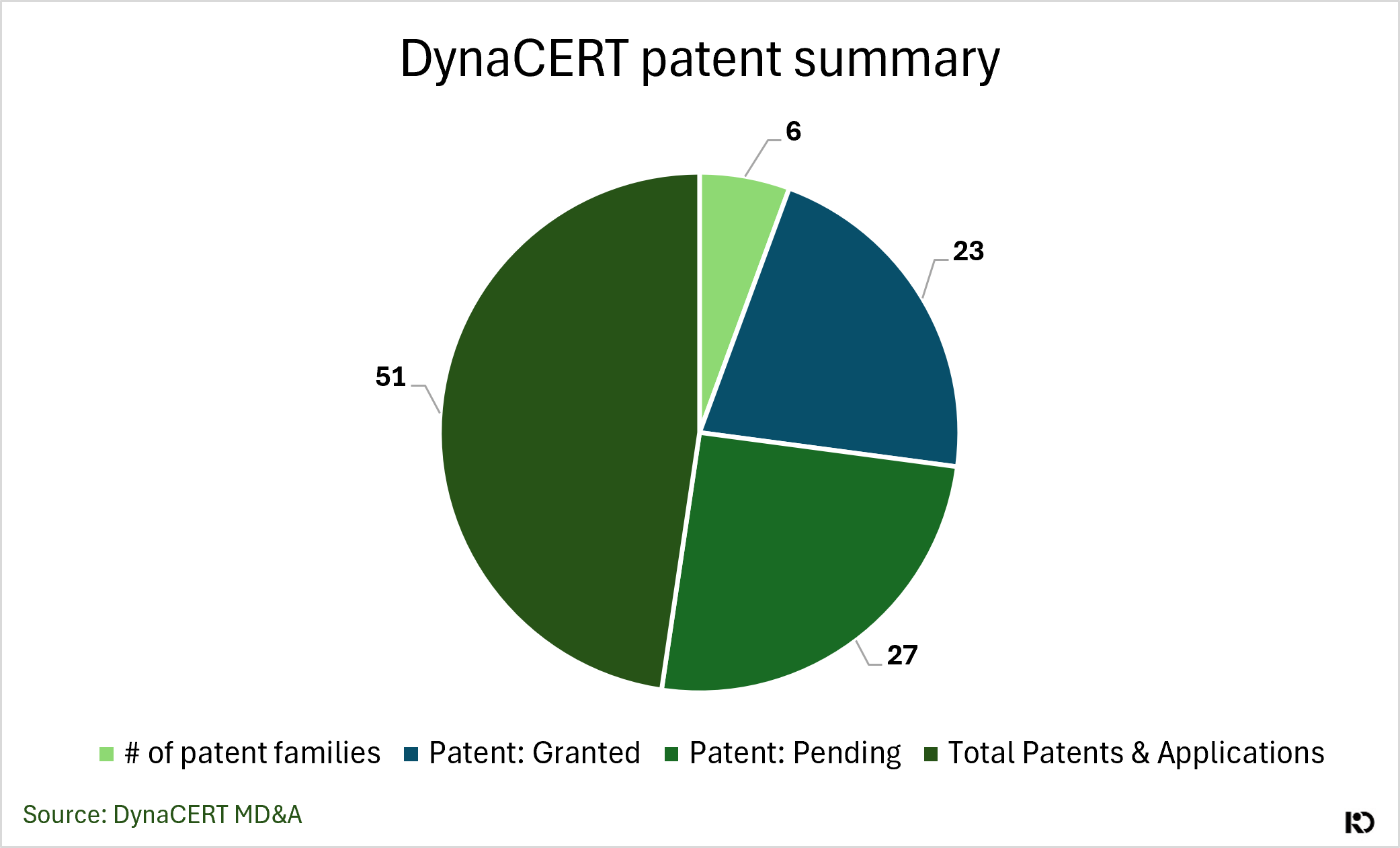

It’s not every day you find a carbon emission reduction company making significant inroads across the mining, construction, logistics, and farming sectors, among others. Currently, dynaCERT holds an impressive portfolio of patents (Chart 3) in key markets such as Saudi Arabia, Israel, Russia, China, the United States, and Germany. The company operates in multiple jurisdictions worldwide, including Canada and Germany, and through agents and dealers in over 55 countries. dynaCERT is making inroads with purchase orders of its HydraGEN Technology (HG1 & HG2) units to Peru and Mexico.

Carbon Credit Optionality & Approval

Its proposed methodology for ‘Improved Efficiency of Fleet Vehicles and Combustion Engines‘ is currently under final review by Verra, with a decision anticipated later this year. Currently trading near its 52-week low of $0.12, the Verra certification, alongside partnerships and collaborations with entities, could grant possible upside to the company’s top and bottom line.

Green Hydrogen

Cipher Neutron has a collaboration agreement with dynaCERT to develop and commercialize AEM Electrolyser technology. This partnership aims to produce larger, more efficient systems capable of generating green hydrogen at competitive prices, positioning both companies at the cutting edge of the hydrogen economy. Canada and Germany recently inked a memorandum of understanding (MoU) to export hydrogen produced in Canada to Germany.

With dynaCERT already in the German market, the Canada-Germany MoU adds further optionality to expand Cipher Neutron’s hydrogen production technology and opens doors to government funding. However, Karbon Offsets has reservations about the current hydrogen landscape due to a greater spread of short-term vs. long-term off-take agreements.

dynaCert VS. Peers

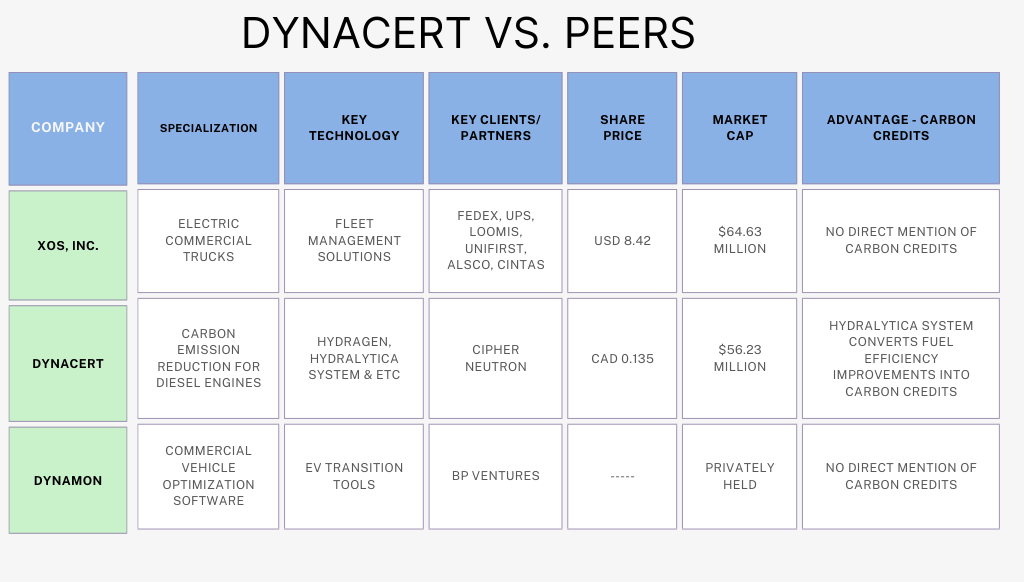

BP Ventures invested £4 million ($5,081,880 USD) in Dynamon, a commercial vehicle optimization software company, on August 3, 2023. Dynamon’s tools facilitate the transition of fleets to electric vehicles (EVs), aiming to reduce operational costs and enhance efficiency. Dynamon is a privately held company based in Southampton, England

Xos, Inc. (NASDAQ: XOS) specializes in electric commercial trucks, providing cleaner alternatives to diesel vehicles and offering comprehensive fleet management solutions. As of May 20, 2024, the company’s share price stands at $8.42, with a market capitalization of $64.63 million. Xos 2024 guidance projects a 50% increase in both revenue and unit deliveries for 2024. Notable clients include FedEx, UPS, Loomis, UniFirst, ALSCO, Cintas, and more.

DynaCERT specializes in carbon emission reduction technology for diesel engines through its innovative patent, which does not require modifications to commercial vehicle engines while improving fuel economy by an average of 10 to 20 percent. Its HydraLytica system measures the enhanced fuel efficiency and the reduction in emissions, converting these improvements into carbon credits. Additionally, DynaCERT partnership Cipher Neutron offers cost-effective green hydrogen options, capitalizing on the growing global interest in hydrogen as an alternative energy source. The share price is currently at CAD 0.135, with a market capitalization of $56.23 million. See also (Chart 4).

Insider Buying/Selling and Holders

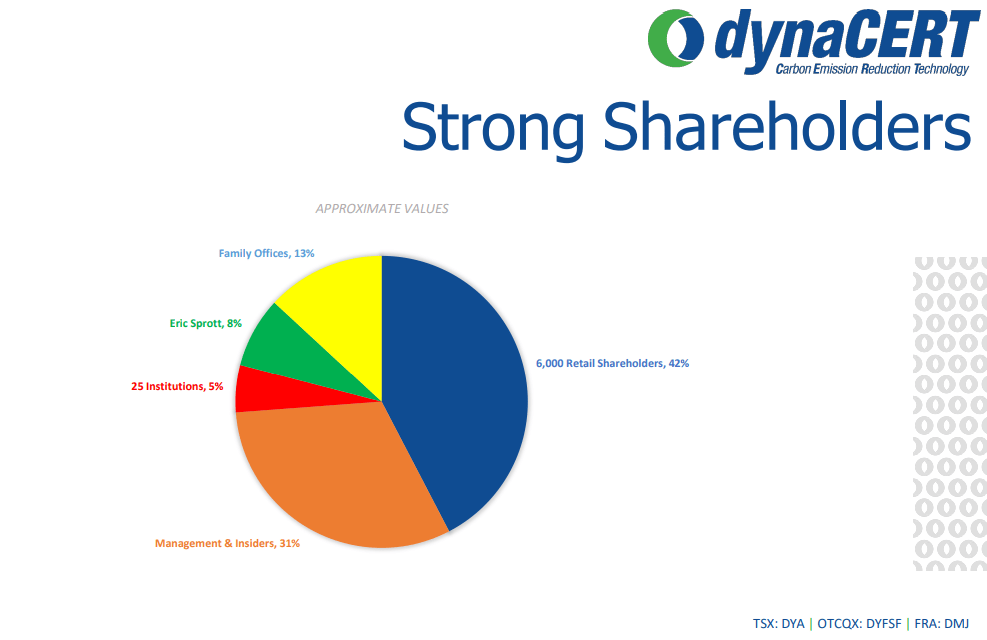

As of May 20, 2024, dynaCERT has a approximate market capitalization of CAD 56.23 million. Insiders continue to purchase equity, with strong shareholder buy-in from family offices, a German asset management company, Eric Sprott, and others. See also (Chart 5).

To conclude, consider the potential bias of ‘Karbon Offsets’ and consult your financial advisor before making any investment decisions. Please note that this brief overview is not a recommendation to invest in dynaCERT Inc.