The U.S. Department of the Treasury, alongside many other officials of the Biden administration, has issued groundbreaking backing, approval, and guiding principles to ensure the integrity and functionality of the Voluntary Carbon Markets (VCMs).

As the VCMs continue to grow and remain quite small compared to other commodity markets (e.g., gold, nickel or soybeans), the U.S. Department of the Treasury believes in the bullish growth of the markets in the coming years through the involvement of private capital in developing high-integrity carbon credits and aiding in reducing greenhouse gas emissions while generating economic opportunities.

With the right incentives and guardrails, Janet Yellen, Thomas J. Vilsack, Jennifer M. Granholm, John Podesta, Lael Brainard, and Ali Zaidi believe policymakers and experts in the space can drive the growth of the VCMs while building innovations to drive down costs associated with carbon removal technologies for market participants and developing countries.

“Many participants have told us that transacting in VCMs is difficult. It’s a fragmented market, with high search costs and low transparency. We encourage market participants to continue efforts to address these challenges through innovative products and services and believe government could play a role here too,” said Treasury Secretary Janet Yellen.

The remark above by Treasury Secretary Janet Yellen is noteworthy, as can we see Validation/Verification Bodies (VVBs) desire for government to flex their muscles to drive down cost for participants through unknown policies or could governments issue some robust subsidies to VVBs to help market participants enter the VCMs.

The endorsement and support of high-integrity carbon credits by the U.S. Department of the Treasury and other officials harp on a few key guiding principles to ensure the future of VCMs, such as:

a) Credit-generating activities and credits should be certified to high standards, ensuring integrity in design and MMRV. This calls for credit certification bodies, i.e., Validation/Verification Body (VVB), to play a greater role in improving credit integrity and ensuring equitable participation by developing countries.

b) More transparency and accountability in building confirmed “co-benefits” from initiatives and programs that generate credits, like enhanced biodiversity and sustainable economic growth.

c) Ensuring that corporate buyers of carbon credits direct actions to reduce emissions are complemented by carbon credits rather than taken over by them. This reverts back to guiding Science Based Targets initiative (SBTi) principles and the U.S. Treasury’s Principles for Net-Zero Financing and Investment.

d) Buyers of carbon credits should make easily accessible declarations of the type of credits that are purchased and retired to stakeholders through regular publications.

e) Credit users’ public statements should fairly depict how retired credits affect the environment.

f) VVB, policymakers, and market participants need to come together to reduce transaction costs facing credit-generating suppliers—including farmers, ranchers, forest owners, small businesses, developing country jurisdictions, and others.

“If done right, Voluntary Carbon Markets can provide new revenue opportunities for farmers, ranchers, private forest landowners, and the rural communities they live in, all while driving needed investment in nature-based climate solutions across the agriculture and forestry sectors,” said Agriculture Secretary Vilsack.

This wonderful news by the most powerful country in the world comes on the heels of SBTi recent plans and announcement on April 9, 2024, to deliver the first draft of basic rules, thresholds, and guardrails for the potential use of carbon credits for Scope 3 abatement purposes by July 2024.

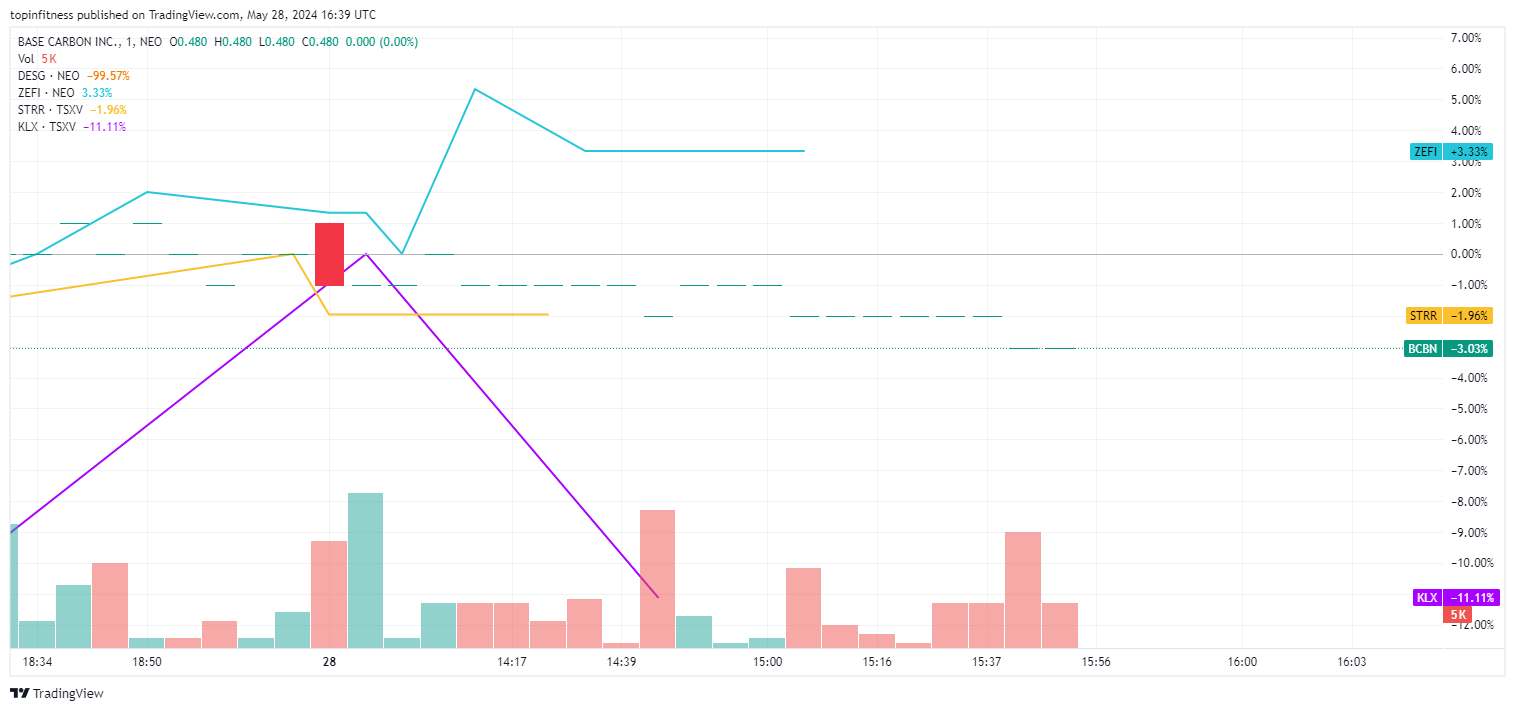

After the positive news was made, notable carbon credit stocks across the board from financing, royalties & streams, and developers such as Base Carbon, DevvStream Holdings Inc, Carbon Done Right Developments Inc, Star Royalties Ltd and etc. remained flat or down for the day as of 16:39 UTC with Zefiro Methane Corp green. See also (Chart 1).

All in all, as the United States elections approach, the VCMs will be an interesting space to watch, depending on which political party is to take the presidential throne.