Key soundbites:

- Retiring cookstove credits in flood-prone and drought-ridden areas is like putting a Band-Aid on a broken leg.

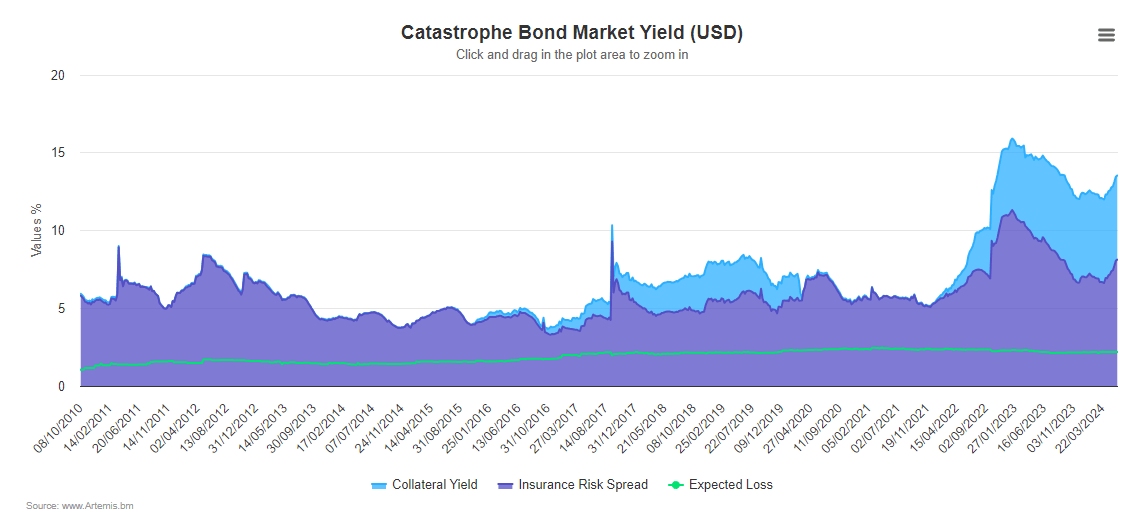

- The rise of the effective federal funds rate (EFFR) to 5.25%-5.50%, the Catastrophe Bond (CAT Bond) market yields have reached an all-time high of 15.91%.

- We can deck out every coal, oil, and gas power plant with the latest CDR technologies, i.e. carbon capture and storage (CCS) facilities. But when a major flood or storm wipes out entire communities

- Markets shouldn’t have to scream high premiums to hint that investing in resilient infrastructure is a must to cut down on overall risk and cost.

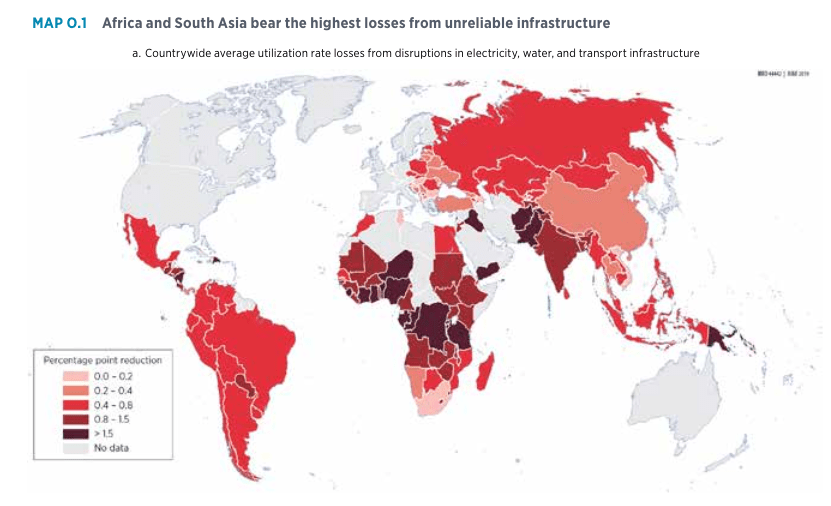

A 2019 report titled “Lifelines: The Resilient Infrastructure Opportunity” by the World Bank highlights the urgent need to invest in resilient infrastructure (Chart 1) to safeguard approximately US$4.2 trillion.

South Africa, Nigeria, Egypt, Algeria, Ethiopia, and Morocco together contribute over US$1.5 trillion to Africa’s gross domestic product (GDP), amounting to nearly half of Nvidia’s market capitalization. Meanwhile, countries such as Kenya, Sudan, Niger, the Democratic Republic of the Congo, Angola, Côte d’Ivoire, and Zambia account for an additional US$387 billion of Africa’s GDP.

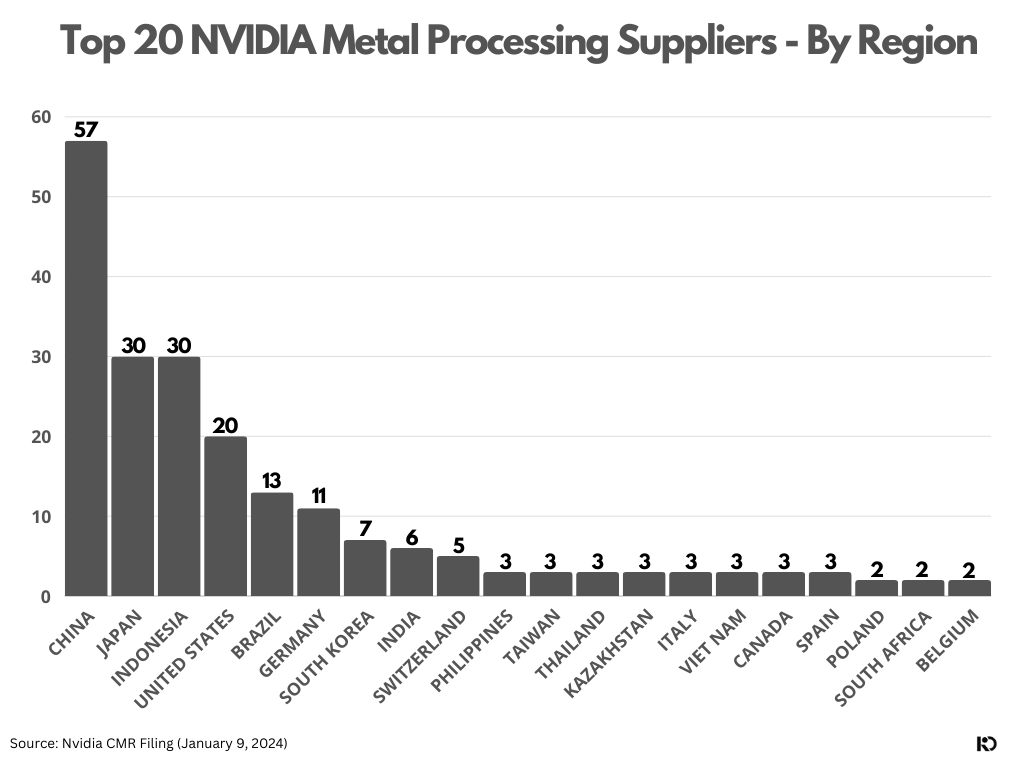

While supply chain (Chart 2) risks and geopolitical risks might be Nvidia’s only threats, for Egypt and Zambia, which are the main focus of this opinion piece, and other African countries, poor infrastructure and development risks are exacerbated by floods and droughts, necessitating ample funding considerations.

Official Development Assistance

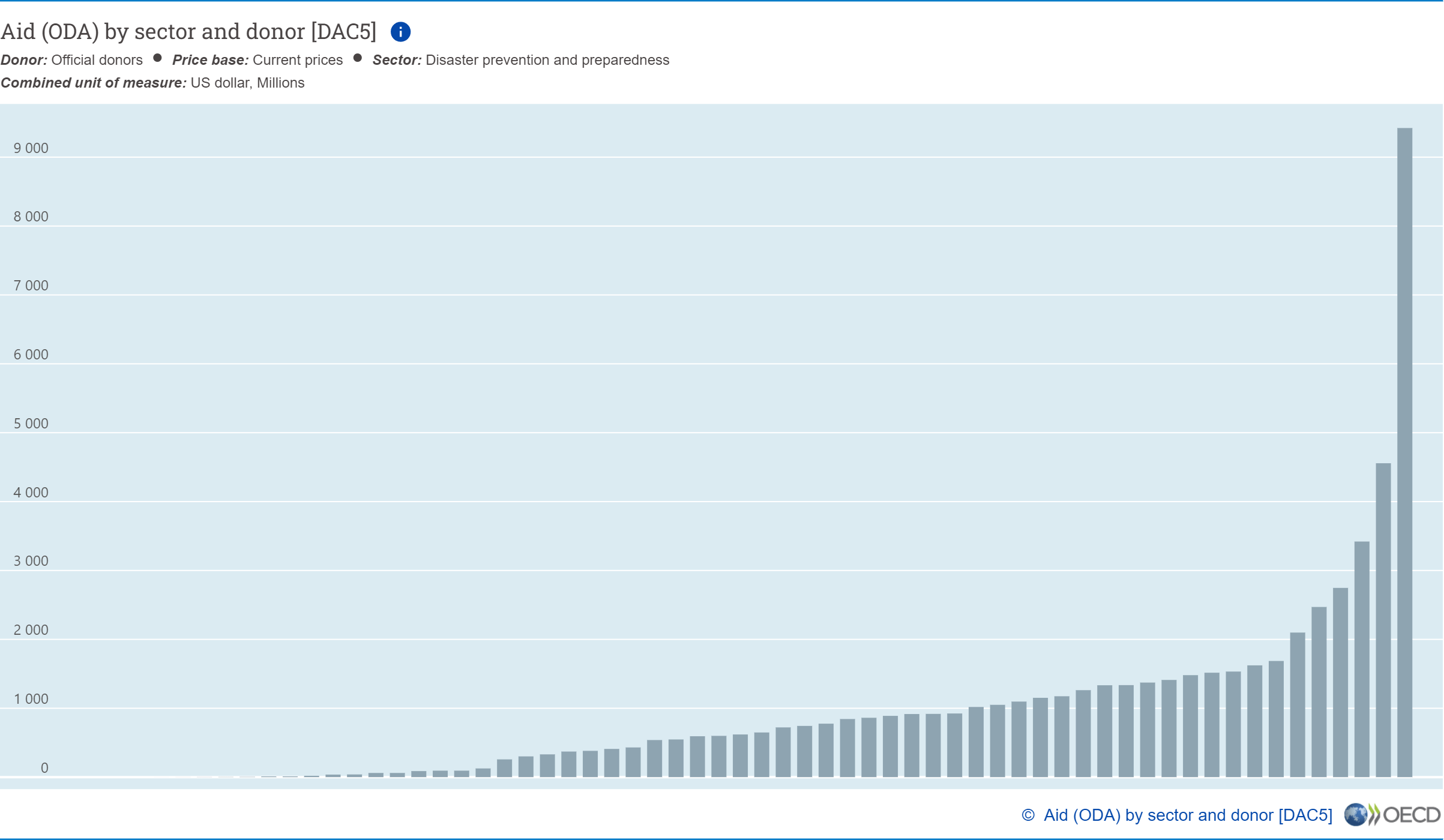

In 2022, official development assistance (ODA) disbursed for ‘disaster prevention and preparedness’ was solely US$6.99 million by private donor Bill & Melinda Gates Foundation. Other private donors such as the Conrad N. Hilton Foundation, Open Society Foundations, and the Rockefeller Foundation barely allocated US$0.6 million. Overall, ODA for disaster prevention and preparedness in 2022 was roughly US$9,423.07 million (Chart 3).

The Need for Resilient Infrastructure

Africa urgently needs help in safeguarding its overall GDP, which is vulnerable due to poor infrastructure and development risks. Delays in addressing these issues increase inflationary pressures, potentially leading to political risks such as currency risk, social unrest, uprisings, and coups. Uncertainty and volatility create opportunities for bad actors to exploit crises.

It is essential for Global North leaders and the masses of the Global South to urge African leaders and media groups to shift their broadcasting language from “climate change” to “flood and drought” mitigation, restoration, and adaptation. Without this focus, flood and drought-prone areas will continue to shrink some African countries’ GDP through fiscal spending and political risks.

Urban Growth and Flood Risks

A 2023 publication titled “Global Evidence of Rapid Urban Growth in Flood Zones Since 1985” showcases that 41% of the Egyptian population is at risk of flooding. Despite the push for carbon credits and climate initiatives, the immediate risk of floods and droughts remains a pressing concern.

We can deck out every coal, oil, and gas power plant with the latest CDR technologies, i.e. carbon capture and storage (CCS) facilities. But when a major flood or storm wipes out entire communities and shatters allocated funds made to erected CCS facilities, what have we, the climate activists and carbon removal policy advisors, really achieved in protecting those communities from CO2 emissions? It’s like installing a fancy security system in a house that’s about to be swept away by a tsunami.

As much as I dream of carbon credits rocketing to the moon, let’s get real: retiring cookstove credits in flood-prone and drought-ridden areas is like putting a Band-Aid on a broken leg. How many lives are we actually saving, or is it just profits over people?

Recent Initiatives

Recently, Zambia and the World Bank BioCarbon Fund Initiative for Sustainable Forest Landscapes inked an Emission Reductions Purchase Agreement (ERPA). This agreement will help communities in Zambia’s Eastern Province tackle forest conservation and climate-smart agriculture. It will also enhance local livelihoods by making clean cooking accessible and promoting sustainable charcoal production. The agreement will grant Zambia up to US$30 million for proven reductions of 3 million metric tons of CO₂e from 2024 to 2029.

Initiatives such as the World Bank BioCarbon Fund Initiative for Sustainable Forest Landscapes are essential for Africa. As the world awaits the operationalization and capitalization of the US$792 million loss and damage fund, there is a need for a transparent and accountable mechanism, along with an intranet platform, to ensure that allocated funds are earmarked and not misused (unearmarked).

Importance of Infrastructure Investment

With some Group of Seven (G7) nations recently cutting their official cash rates , the issue of poor infrastructure and development risks should be a global concern. In the United States, since the rise of the effective federal funds rate (EFFR) to 5.25%-5.50%, the Catastrophe Bond (CAT Bond) market yields have reached an all-time high of 15.91%.

Whether in Africa or elsewhere, as official cash rates begin their downward trajectory, it is crucial to remember that resilient infrastructure paired with carbon dioxide removal (CDR) technologies and increased funding to resilient infrastructure can lead to a more stable and prosperous global economy. Markets shouldn’t have to scream high premiums to hint that investing in resilient infrastructure is a must to cut down on overall risk and cost. Political risks, inflationary pressures, and loss of life are far too serious to be utilized as bookmarks in ones trading strategy. Let’s keep those in the realm of reality, not investment speculation.