We’ve entered the month of April, which marks the beginning of proxy season, where shareholder proposals are voted on for or against. Among these proposals during this proxy season, the Royal Bank of Canada (RBC) recently agreed to disclose its absolute financed emissions for the oil and gas sector annually. This response comes ahead of its annual meeting on April 11, 2024.

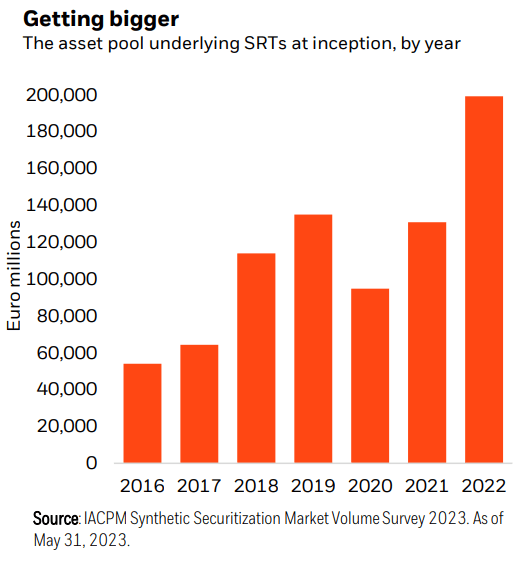

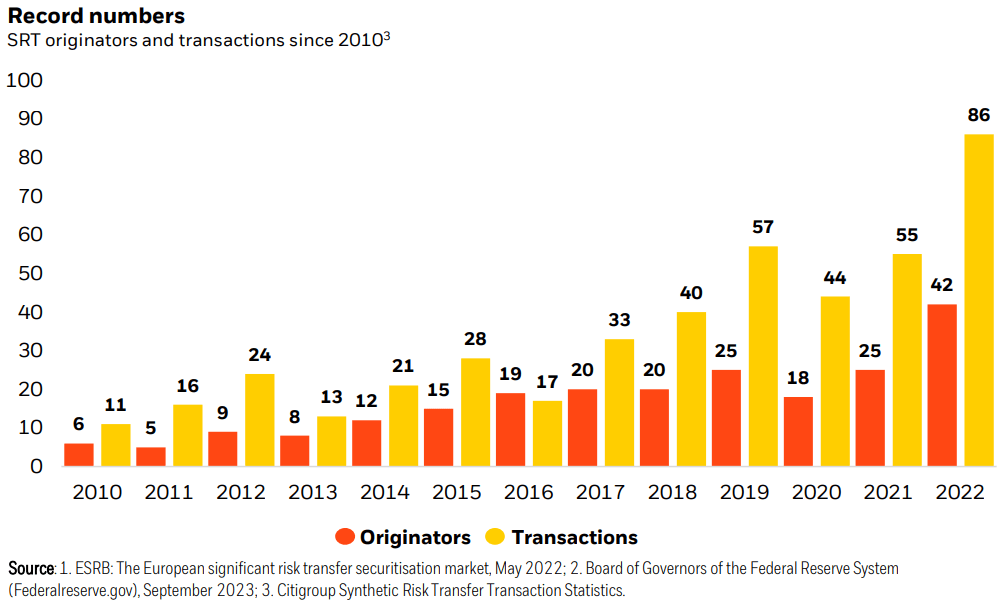

This resolution by RBC caught my attention. Hence, I began pondering about the growth in ‘off-balance sheets arrangements or commitments’ among buy-side entities (Chart 1 & 2).

In the banking world, an off-balance sheet arrangement or commitment, such as synthetic securitization transactions, allows banks to carefully transfer default risk and lessen capital requirements dictated by federal banking regulators onto investors. This structure grants investors an open door to engage in credit risk sharing with a bank, while helping the bank stay whole against loan risk defaults. Some of these arrangements are classified into structured entities, securitizations, guarantees, and other commitments and at time executed through credit insurance.

That being said, could there be a case where banks can simply offload their on-balance sheet financed emissions intensity and carbon liabilities to a private entity without actually ending the financing of oil and gas projects, while still profiting from interest payments and/or premiums, and have their balance sheet clean of scrutiny by environmental activists? Yes, of course.

Here’s the thing:

1. Imagine the possibility of being the owner of a publicly traded bank in Sweden called ‘123 Bank.’ You’re interested in structuring an ‘off-balance sheet arrangement’ because public shaming by environmental activists has grown. Ninety percent (90%) of your investment is tied up in financing oil and gas entities and other emission-intensive sectors in Europe. Additionally, you hold an on-balance sheet financed emissions intensity of 70 million tonnes of carbon dioxide equivalent.

2. In this scenario, you make a call to ‘ABC Partners’. ABC Partners are experts in structuring ‘carbon risk securitization’ or ‘financed emissions risk transfer.’

3. In a meeting, high above their sixty-seventh floor skyline conference room, you arrive and throw around a few jests with their ‘Derivative Director,’ then present your predicament.

4. The director of derivatives at ABC Partners agrees to a deal to structure a carbon risk securitization of your financed oil and gas portfolio, off your books.

5. However, in excitement over the agreement, you are caught off guard by the cost associated with structuring such a simple yet diabolical off-balance sheet arrangement. The derivative director quotes you a twenty percent (20%) premium annually to execute this climate injustice deal.

6. You’re desperate! In an effort to rebrand your bank, you agree to the deal and quickly stretch your hands to clinch it.

7. Now, the investor (ABC Partners) hides your dirty little secret and gets paid a 20% premium annually from the deal.

8. In your next sustainability or ESG report, or climate-related disclosure, there is barely any need for the purchase of carbon credits because of brilliant financial engineering.

For environmental and climate justice activists on the front lines fighting to mitigate climate change, their “hope” in the financial engineering of the aforementioned scenario involving 123 Bank is financial disclosure or climate-related reporting of its investments. Either declared in tiny footnotes of such off-balance sheet ‘carbon risk securitization’ or ‘financed emissions risk transfer’ commitments. Without this piece of information, it will be a complete climate injustice or a financed emissions risk transfer ponzi scheme against meeting 1.5 degrees Celsius or below climate goals.

In a recent story by Bloomberg, a bespoke boutique entity for structured opportunities, such as synthetic risk transfer under the name Newmarket Investment Management, LP, and its affiliated entities, are in talks with institutions regarding such structures.

Currently, under the rules of the Global GHG Accounting and Reporting Standard for the financial industry by The Partnership for Carbon Accounting Financials (PCAF), ‘financed emissions’ on off-balance sheet items, such as loans and lines of credit, are excluded from reporting. Could there possibly be a new accounting system to measure such structures by PCAF or will there be a regulator for carbon securitization risk sharing market- fun times.

In regardless, as noted by The Commodity Futures Trading Commission’s Climate-Related Market Risk Subcommittee of the Market Risk Advisory Committee (MRAC) of the Commodity Futures Trading Commission, a dire claim was made when they noted, ‘Climate change poses a major risk to the stability of the U.S. financial system and to its ability to sustain the American economy.’ However, above all, the world as a whole must commit to addressing the growing risk of weather patterns that are threatening commodities, infrastructures, causing human displacement and consumer price inflation.

Off-balance sheet ‘carbon risk securitization’ or ‘carbon risk-sharing’ or ‘financed emissions risk transfer’ commitments won’t move the world into mitigating climate change or drive capital or liquidity toward creating innovative adaptation measures to be resilient against natural catastrophes. Instead, they will only undermine all efforts for insetting and offsetting.

Note:

To learn more about off-balance sheet arrangements and commitments by banks. Please review any banks annual report or feel free to reach out to Karbon Offsets at info@karbonoffsets.com as I may be able to guide you to some resources.