- The International Swaps and Derivatives Association (ISDA)’s recognition of Gold as a hedge against climate risk.

- Gold’s price rise will be seen during an “economic turmoil.“

- Entertaining the possibilities show signs of a possible false break-out

An AP Archive YouTube clip dated December 16, 1997, titled “China – Shoppers Go Mad Buying Gold,” features the following excerpt which narrates:

Prices are still relatively cheap here, cheaper in fact, than they have been for 18 years. And those with cash have cash to spare. Affluent Chinese are cautious savers. National savings rates are amongst the highest in the world. The stock markets are depressed, and interest rates have fallen, fueling interest in Gold.

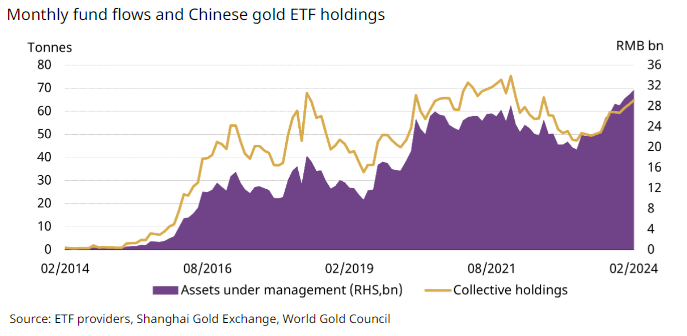

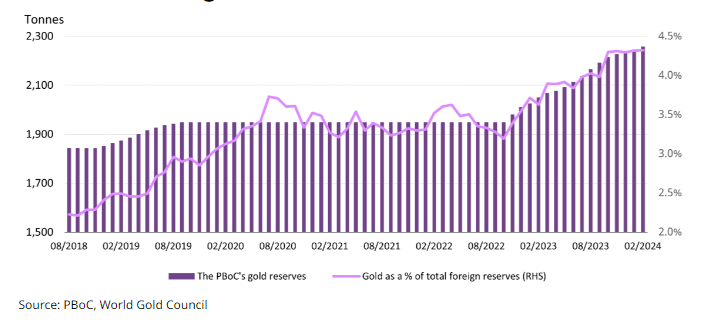

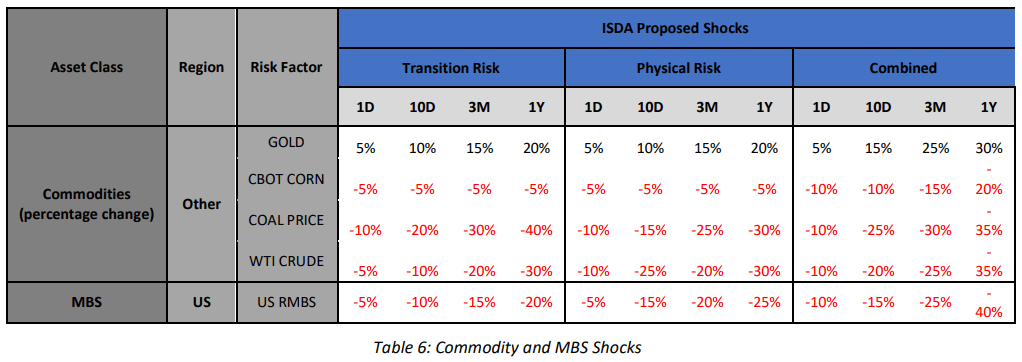

Since 1997, the Chinese government has encouraged its citizens to buy Gold, a wise move due to its link to both short-term and long-term climate risks hedge highlighted by an International Swaps and Derivatives Association (ISDA) view on March 28, 2024 titled ‘Preparing for Climate Disruption.’ Concurrently, Chinese Gold exchange traded funds (ETFs) continue to gain momentum (Chart 1), as does the People’s Bank of China’s purchasing of the metal (Chart 2).

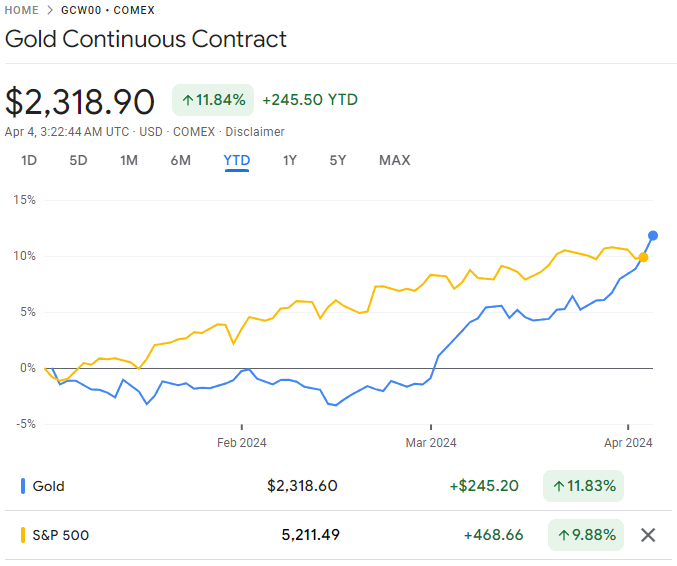

Year-to-date, Gold has outperformed the S&P 500 by 173 basis points as of April 4, 2024 3:22 AM UTC, reaching an all-time high of $2300/ounce two (2) days ago. Many speculators, investors, and I would consider it a bull market, fueled by geopolitical tensions and inflationary pressures. In my argument, these pressures persist due to monetary and fiscal policies that fail to address infrastructure needs or policy measures to lower prices, exacerbated by ongoing lobbying from certain industry oligopolies.

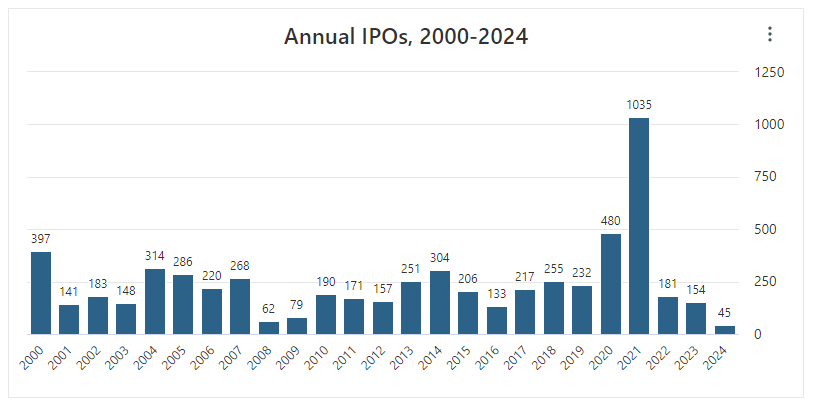

Apart from Reddit’s recent initial public offering (IPO), annual IPOs in the United States are barely rising (Chart 3). In Canada, there was only one (1) IPO on the Toronto Stock Exchange, per data compiled by Bloomberg in 2023; while the United Kingdom saw just 23, the lowest since 1995. The global economy since Covid-19 for small-businesses and IPOs show no massive boom.

Above all, the Chinese government’s call for its citizens to purchase Gold, while commendable, may also align with the International Swaps and Derivatives Association (ISDA)’s recognition of Gold as a hedge against climate risk above many other varying reasons. It’s worth noting that ISDA is a crucial advocate for transparency and risk management in derivatives markets globally.

Therefore, what if the rise in Gold price is due to climate risk hedging? Is Gold anticipating a decline in consumer spending, businesses unable to perform due to climate change, high borrowing costs, and small-and-medium-sized businesses shutting down? This is exactly what ISDA shares in its ‘Climate Risk Scenario Analysis for the Trading Book,’ which suggests that Gold’s price rise will be seen during an “economic turmoil.” The price of Gold is rising! Is Gold in a bull market, or are climate transition and physical or combined risks driving its price up?

Let’s examine why and how the rising price of Gold may be attributed to some, but not all, reasons by utilizing ISDA’s climate risk scenarios on “Volatilities and Probability of Defaults” with the following charts presented in its modeling and more.

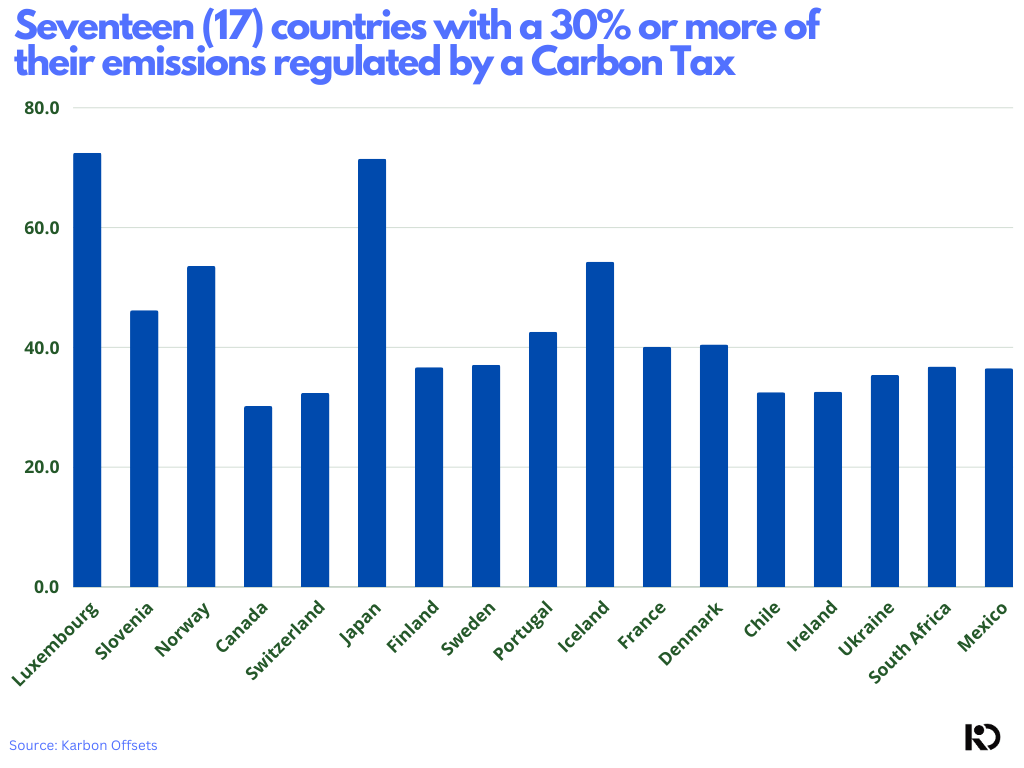

In a transition risk scenario. Approximately seventeen (17) countries have 30% or more of their emissions regulated by a Carbon Tax (Chart 4).

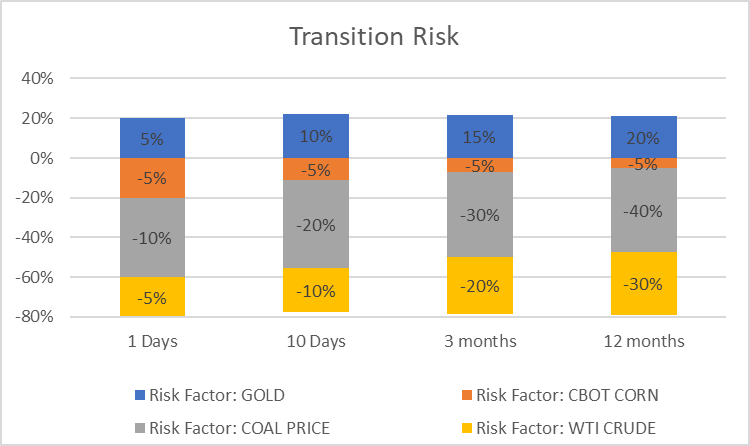

Additionally, increasing inflationary pressures, evidenced by current rising commodity prices, a rise in carbon tax, and high borrowing costs in countries lacking the privilege of a 30-year fixed-rate mortgage standard like the United States, may be contributing to Gold being perceived as a ‘flight to safety,’ indicating a sense that something is about to break. As you can see in (Chart 5) Gold outperforms all commodities in a transition risk scenario as indicated by ISDA in this scenario.

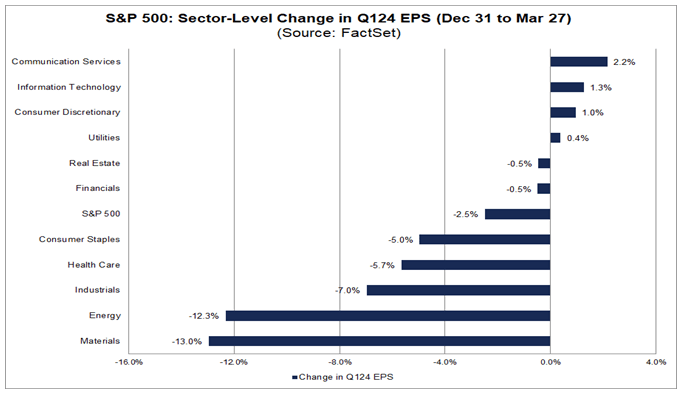

In a physical risk scenario. Q1-2024 earnings season is here. Tesla’s disappointing vehicle deliveries, announced on Tuesday, April 2, 2024 in a press release, led analysts to swiftly lower earnings estimates for the electric vehicle maker for the remainder of the year. In addition, FactSet’s S&P 500 Sector-Level Change in Q124 earnings per share (EPS) (Dec 31 – Mar 27) chart reveals a significant change in the EPS decline estimates of the material and energy sectors, followed by the industrial and healthcare sectors (Chart 6).

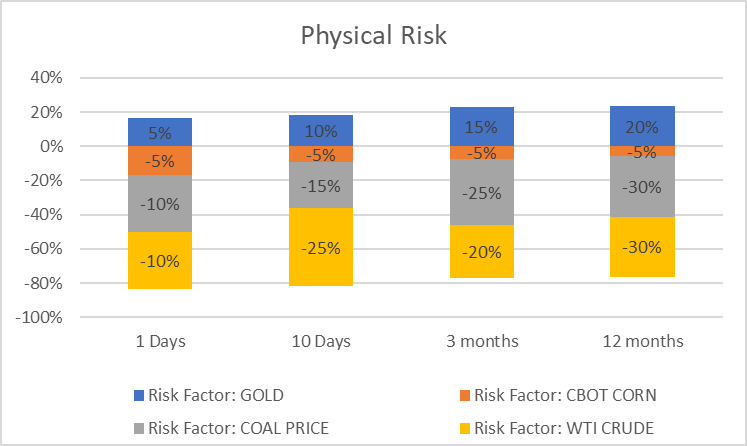

Is the rising price of Gold indicative of an economic slowdown, amid physical climate risks (Chart 7). Entertaining the possibilities show signs of a possible false break-out of a bull market in Gold.

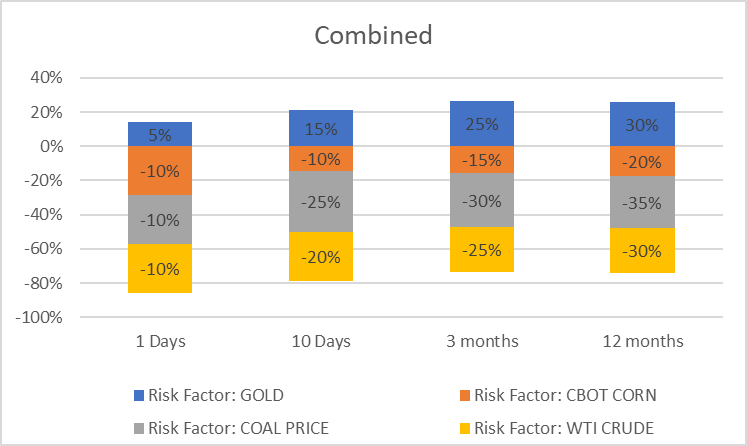

In a combined risk. ISDA points out that “Gold rises as a safe haven during stock downturns, affecting commodity prices; and a carbon tax hike hits oil and coal prices. Are we seeing the performance of Gold ahead of a mounting crisis. (Chart 8)

Regardless of the scenarios, I’m not suggesting rushing out to buy Gold; rather, take a moment to consider other factors driving its price rise. Janet Yellen is currently in China, from yesterday until April 9th, 2024, discussing promoting financial stability and assessing climate change risks, among other topics with Chinese officials. What insights are they seeing that you’re not seeing, and possibly Gold already knows.