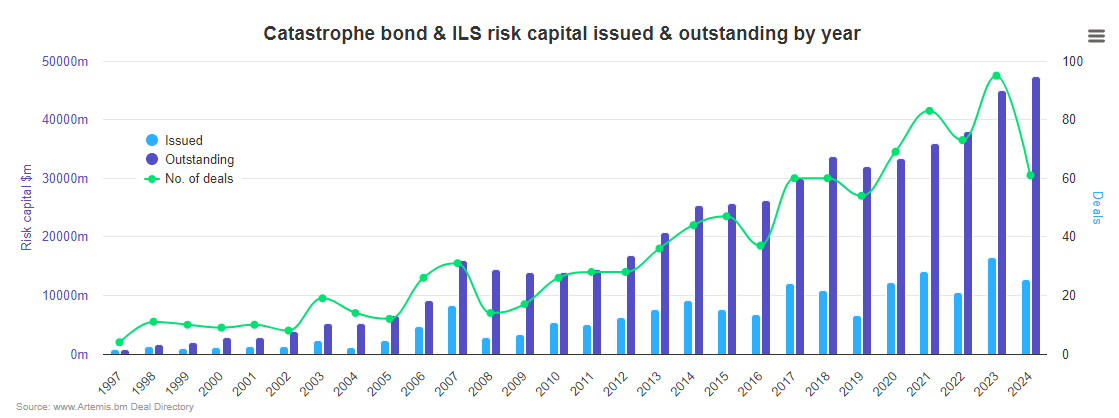

In approximately 72 days, Brookmont Capital Management, a specialist in dividend equities, will launch the first-ever Catastrophic Bond ETF in the United States. Trading under the ticker symbol ‘ROAR,’ this soon-to-launch ETF will be listed on the New York Stock Exchange (NYSE), granting retail investors access to catastrophe bonds (see Chart 1), which are typically available only to institutional investors.

Key Features of the ROAR ETF

Based on Brookmont’s Catastrophic Bond ETF preliminary prospectus, the ETF aims to offer an actively managed exchange-traded fund (ETF) that will invest close to 80% of its net assets in catastrophe bonds. It aims to generate income through interest payments from catastrophe bonds while focusing on preserving capital by carefully selecting bonds and other insurance-linked securities (ILS).

Market Timing and Federal Reserve Policies

With the S&P 500 up 17.73% year-to-date and markets pricing in a Federal Reserve rate cut in September, is launching a Cat Bond ETF now the right move? Yes! Diversifying a portfolio beyond credit risk, the ROAR ETF will provide retail investors with access to ‘event risk’ catastrophe bonds, primarily associated with hurricane risks in Florida. This focus leverages the higher availability and market proportion of these investments compared to other perils.

In addition, Cat Bonds tend to have a monthly interest rate adjustment and act as variable rate bonds, providing returns that are calculated using the rate on a one-month T-bill plus a spread. Hence, they adjust upward in line with increases in short-term rates, which typically result from inflation. Whether invested in the ROAR ETF or not, retail investors will have access to answers and sentiment reflected in the price of the ROAR ETF.

Environmental, Social, and Governance (ESG) Considerations

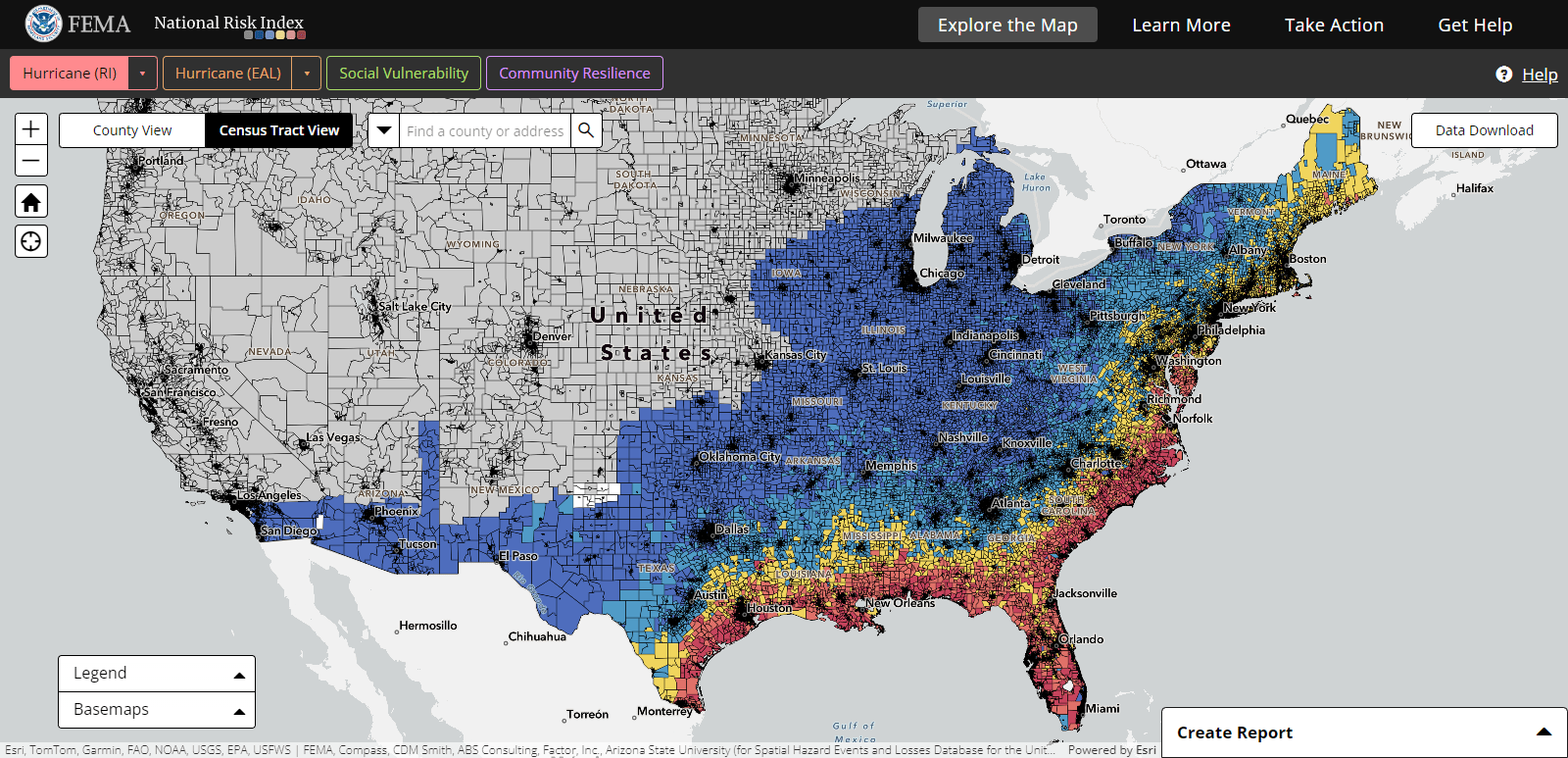

While markets await the expense ratio or fee associated with the ETF to be announced. Retail investors should keep note that the southeastern region of the United States is rated by the Federal Emergency Management Agency (FEMA) National Risk Index as ‘very high’ for hurricane risk, especially in Florida, Texas, and Georgia (see Chart 2).

For environmental, social, and governance (ESG) investors or those sustainability-conscious investors looking to hold a security aimed at fostering climate resilience and hedging their portfolio against the effects of natural catastrophes, it would be wise to research and monitor Brookmont’s Catastrophic Bond ETF as it lists in the next 73 days. After all, it’s not every day you get to invest in hurricanes without getting wet!

Investor Distribution by Geography

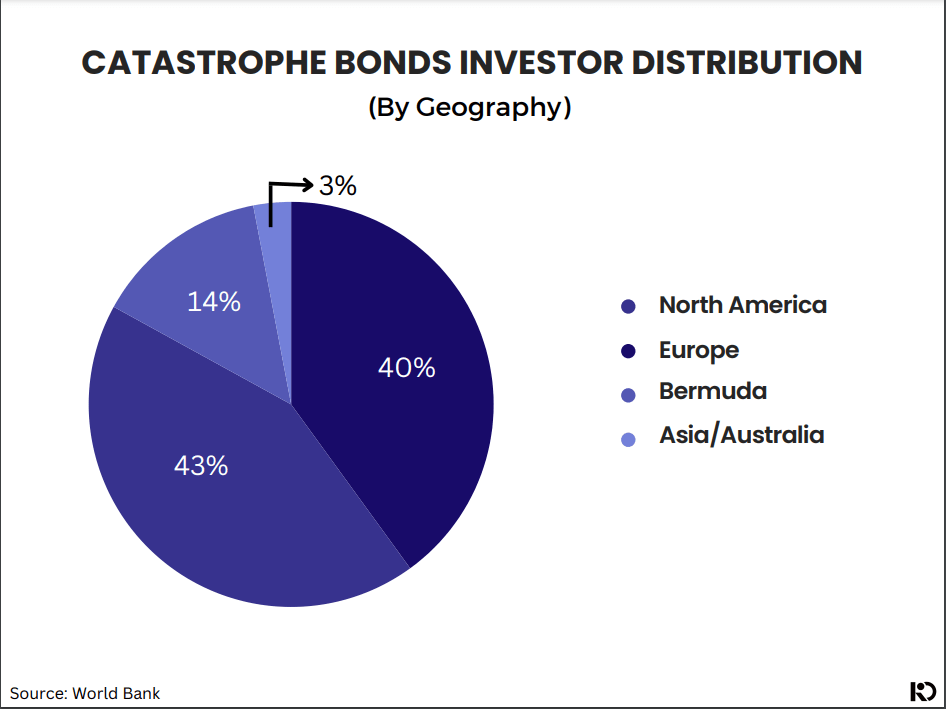

Also, see Chart 3 for a detailed breakdown of Catastrophe Bonds Investor Distribution by Geography. The chart shows that 43% of the investments come from North America, 40% from Europe, 14% from Bermuda, and 3% from Asia/Australia. This distribution brings to light the significant global interest in catastrophe bonds and the regional variations in investment preferences.