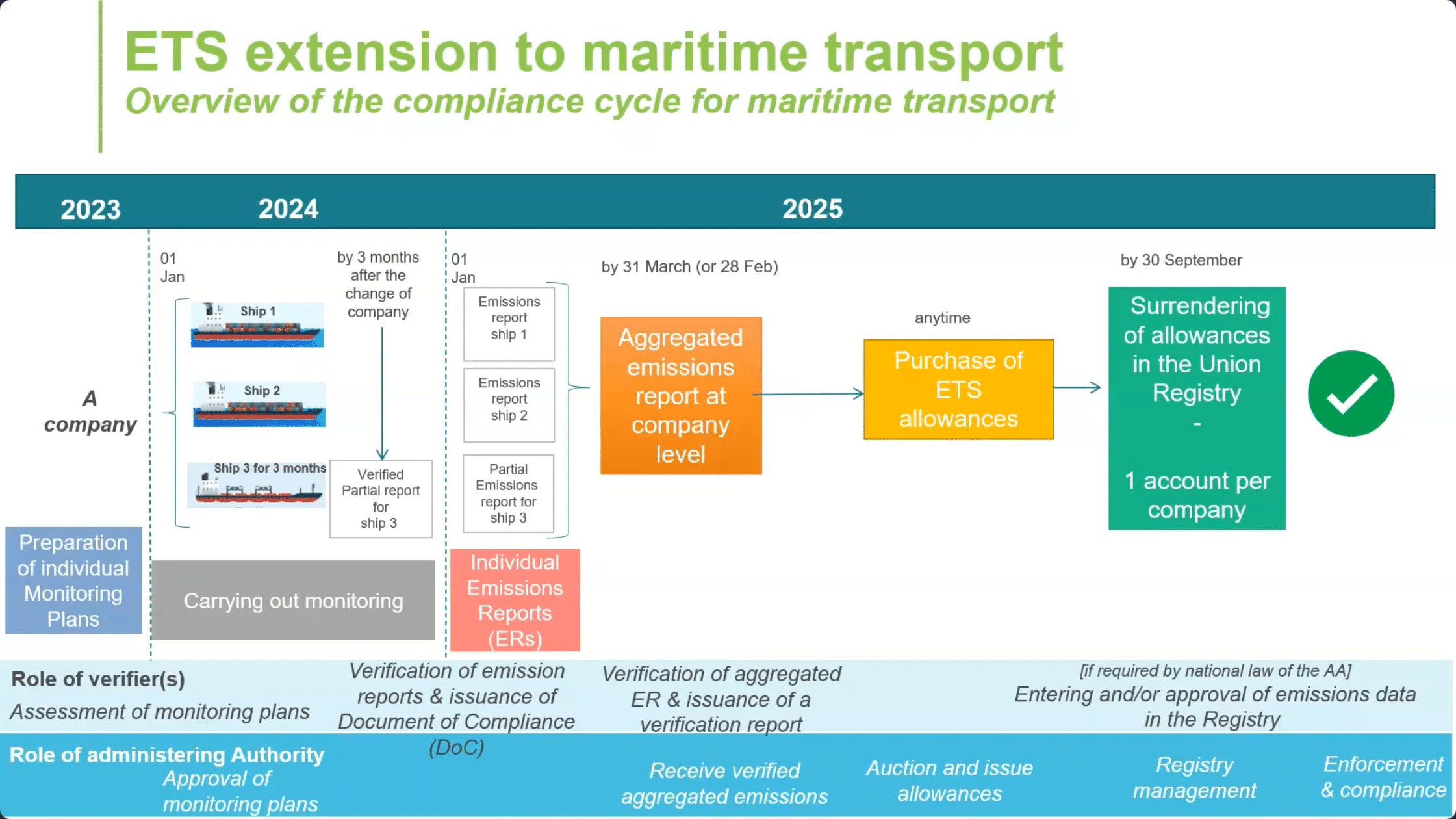

As part of the European Union Emission Trading System (ETS) extension to maritime transport. Maritime transport companies will monitor their emissions and buy and forfeit ETS emission allowances for each tonne of GHG emissions to be reported under the European Union Emission Trading System (ETS).

Maersk and Hapag-Lloyd among others have stated international shipping costs between the thirty (30) countries in the European Economic Area (EEA) and the European Free Trade Association (EFTA) are set to rise next month as the EU Emission Trading System (ETS) becomes effective on January 1, 2024.

The additional costs incurred in compliance with the EU ETS will be billed to the company only for bookings where the loading and/or discharge ports are within the EU or EEA. For instance, if a cargo is shipped from a loading port in Malaysia to a delivery port in Switzerland, the Emissions Surge will be applied as follows:

- If the discharge port (ocean) of booking is Switzerland (Netherlands), an EU and EEA country, an emissions surcharge will be applied.

- If the discharge port (ocean) of booking is Turkey, a non-EU/ EEA country, the emissions surcharge will not be levied.

As per Maersk, they’ve noted, surcharge codes will be presented as EMS on invoices for bookings under contracts with a validity exceeding 31 days and presented as ESS (Emission for surcharge on spot bookings and contracts with validity less than or equal to 1 month).

The emissions surcharge will be charged on top of the contracted rates and updated every quarter to ensure invoices are correctly processed, and the required payments are made on time.

As the first major global carbon market, ETS is designed to help promote clean shipping while helping the EU achieve its net zero goals by 2050.

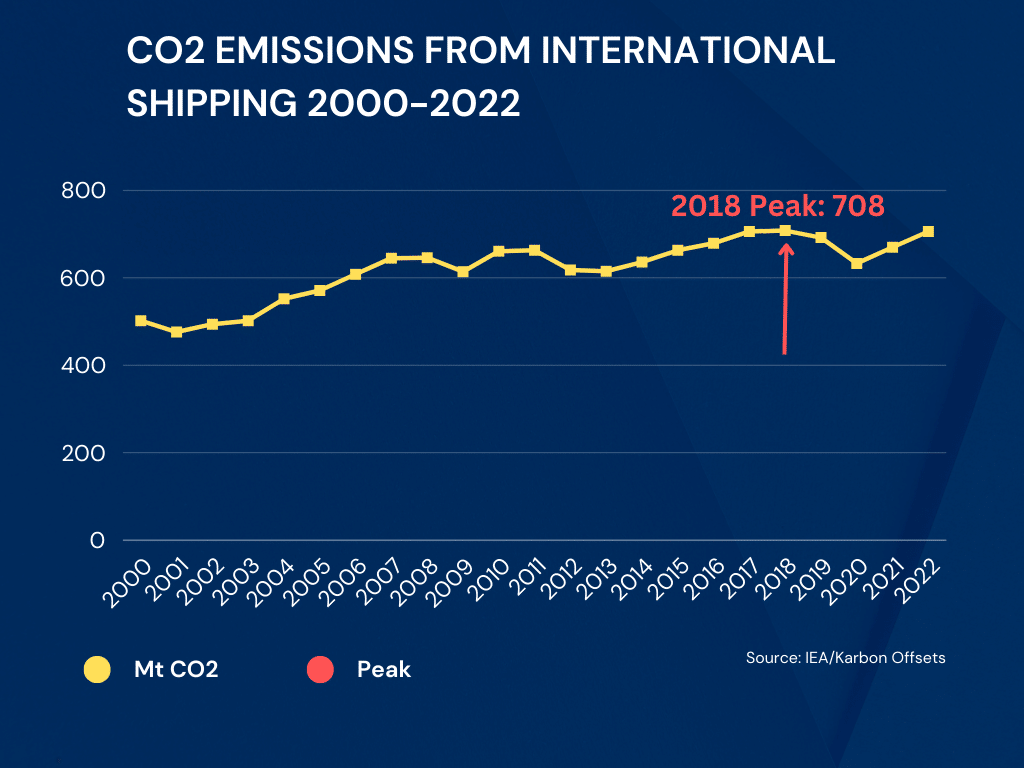

The new CO2 reduction initiative comes when global regulators are doubling down on emission reduction policies to reduce shipping emissions following a 5% increase in 2022, making IMO’s GHG reduction targets more ambitious.

Although the system is set to reduce the cap on emissions every year, it does not warrant emission reduction but aims to create a CO2 pricing market to incentivize CO2 emission reduction. According to the ETS system, companies involved will pay 40% of their total CO2 emission during 2024 in 2025, 70% of emissions released in 2025 in 2026, and 100% of the company’s emissions from 2027 onwards.

According to data published by Transport & Environment, MSC, CMA CGM, MAERK, COSCO, and Hapag-Lloyd are responsible for the bulk of GHG emissions in maritime shipping, with MSC taking the lead.

Source: Transport & Environment

Source: Transport & Environment

With the shipping companies expected to pay sufficient allowances per ton of CO2 emitted to cover 100% of their emissions between EEA and EFTA ports and 50% of their emissions between a non-EEA/EFTA port and an EEA/EFTA port, the allowance acquisition may potentially increase shipping costs for customers, with shipping companies already sending advisory to their customers.

“Hapag-Lloyd welcomes the addition and views it as a key step towards setting uniform standards that will help both the environment and people. We aim to set up a customer-friendly solution that enables a calculation of costs for our customers that is causal, transparent and easy to understand – and that clearly displays the EU ETS added costs’ levels,” Hapag-Lloyd stated in a newsletter published on September 22, 2023.

A.P. Moller–Maersk also published an advisory for its customers on December 1, informing them that shipping will be included in the EU ETS, putting a price on the company’s GHG emissions.

“The additional cost incurred to comply with the EU ETS directive will be applied to bookings under the EU ETS scope as a standalone surcharge, known as “Emissions surcharge,’ defined on a trade basis,” the company added.

Recently, CMA CGM notified its customers of the surcharges beginning next month, when the EU ETS will become effective, mandating the company to pay for its emissions.

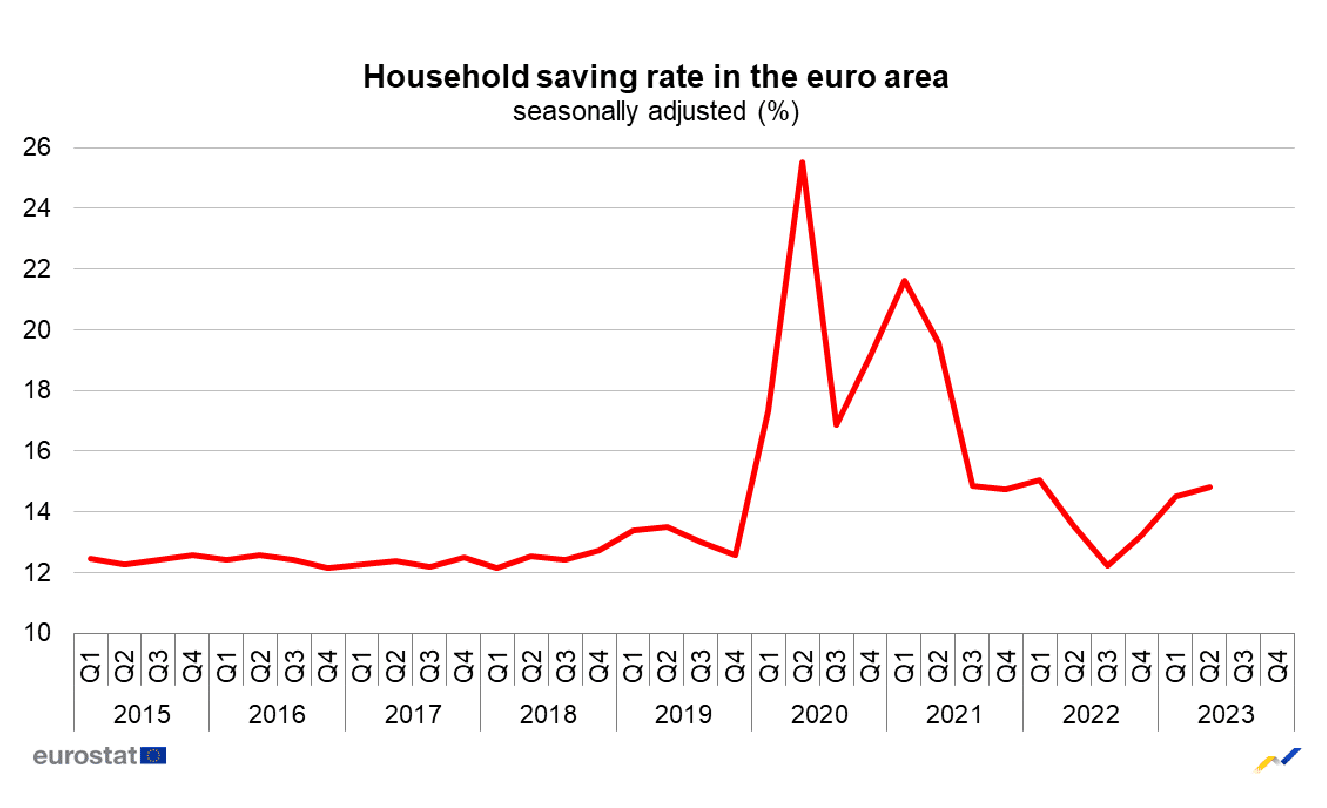

Although this measure is hailed as one of the ways to help achieve net-zero goals by 2050, with growing geopolitical risks in the Middle East and the household saving rate in the European Union up 14.8% in the second quarter of 2023 from 14.5% in the first quarter of 2023, customers in the European Union may stand to bear the brunt of the company’s emissions by paying for cost recoveries.